Businesses and organizations who rely on customer service agents to handle incoming calls for billing payment remittance are at the top of the list for those who can best benefit from adopting systems from Electronic Bill Presentment Companies. Let’s examine some reasons why…

1. Reduction in customer service costs

Live customer service agents, no matter if directly employed or outsourced, can be extremely expensive to an organization. Not only are there hourly wage expenses, but there’s also paid time off for vacations, sick days, medical absences and benefits. The vacation time and sick days also create scheduling problems, and in some cases, overtime expenses. Then there’s the billing cycle to consider. If billing cycles amount to a few particular days of the month, this creates peak times in which the customer service staff is needed to field the calls – and down-time for other times of the month which can amount to either staffing inefficiencies or part time labor that can result in high turnover rates. Implementing a service from one the many Electronic Bill Presentment Companies can drastically reduce customer service expenses.

2. Customer Convenience

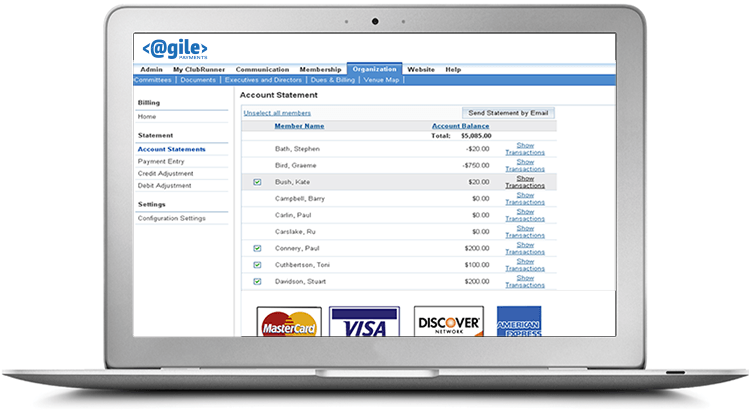

Customers don’t like to wait on hold when they call to remit a payment, and they also are shifting more and more to remitting payments via the web. Electronic Bill Presentment Companies can certainly supply solutions for organizations where a customer can quickly search locate an invoice, then remit a payment – all from a PCI compliant platform with no sensitive financial data ever touching or being stored on the organization’s web server. Moreover, many electronic bill presentment systems run in concert with an IVR Payments system, in essence duplicating invoice data and making it available for either method that a customer chooses to pay by. So if Suzy Jones remits a payment via the electronic billing system, the IVR system automatically knows that a given invoice has been paid. EBPP systems can handle huge volumes of transactions, all with no customer service time required. Many systems also have the capability to present an invoice via email or SMS, further enhancing customer convenience.

3. Reduction in Paper Check handling

3. Reduction in Paper Check handling

The costs involved in the handling and processing of mailed-in paper checks can be significant for an organization. Even if outsourced to a bank or a company that specializes in lockbox processing, there are significant costs. Often, the lockbox businesses outsource labor offshore. Either way there are data theft risks incurred with paper check handling, where EBPP can significantly reduce the risk exposure, or even eliminate it all together. EBPP is also faster. There’s simply no waiting for the check to arrive via the postal service. Then there’s also the time required to sort and remove staples from invoices and attached checks. Once that’s completed there the waiting time after deposit for the funds to be made available. No matter what way you look at it, EBPP is far more cost effective than any form of paper check acceptance.

Agile Payments has been assisting organizations and businesses of all sizes in making their receivable methods more efficient for 18+ years. We’re here to listen to whatever your organization’s needs are and present solutions that make the best sense for you.

3. Reduction in Paper Check handling

3. Reduction in Paper Check handling