The PayFac’s role is to quickly and easily onboard sub merchants to facilitate credit, debit card and in some case ACH transactions for participants in their payment ecosystem.

Topics:

Get in touch with us!

Payment Facilitation offers a SaaS platform the ability to accept payments on behalf of it’s end users. The application users completes a simple application and in minutes can begin accepting credit, debit cards as well as ACH [in some cases].

This ability to onboard clients without having the user apply for a traditional merchant account [that can take days and require supporting documentation like bank statements and tax returns] offers a friction free onboarding experience.

An example would be a SaaS platform that provides plumbers and home service providers an application that help them manage appointments, inventory, route mapping, CRM and payments. The payment collection module is a part [ very important on] of the SaaS platform offering. New end customers sign up for the platform and as part of their onboarding they provide business information and their bank account information. In the past that plumber would have had to complete a fairly onerous merchant account application, wait up to week for approval and then have to enter their credentials into the SaaS app.

See “Is Payment Facilitation a good option for SaaS Platforms?”

Payment Facilitation for Platforms

The platform integrates and implements and then the plumber simply provides enough information to satisfy KYC requirements and provides bank info. That’s it-the platform receives payment credentials from the PayFac partner via API. And that simply the plumber can accept payments. For any application with payments this model offers the ability to differentiate their app from competitors and use the payments component as a client attraction tool. Sounds great–the catch? Read on.

Some well known payment facilitators or Payment Service Providers [PSP’s] are PayPal, Stripe and Square.

PayPal was the pioneer in providing payment acceptance tools for marketplace sellers. Many of these sellers would have found it difficult and downright confusing to apply and obtain their own merchant account. It is also very likely many would not have qualified or been approved for a merchant account as many were not traditional businesses but rather an individual buying and selling. PayPal [history here] offered a simple way [in the beginnings it wasn’t so simple] to enroll and start processing payments.

The key differentiator is that PayPal offered a master payment account. This “master merchant” model initially was prohibited by credit card associations [MasterCard and Visa] and credit card acquirers, e.g., Vantiv, Wells Fargo, Elavon etc. PayPal grew rapidly and ultimately there was a lot of money to be made so gradually the attitude toward the facilitation model changed. It was very much the “horse is out of the barn” and the card associations were forced to reexamine this new business model. When Squarefirst launched you saw a very similar dynamic: Square acted as the Payment Facilitator and really took frictionless onboarding to a new level-buy your reader at WalGreens, fill out form online and in same day start taking payments. very powerful customer acquisition tool and this was a huge part of their rapid growth.

Vantiv became the first acquirer to actually support and develop tools for managing the complexities of simple onboarding and risk controls as well as payout tools for sub-merchants. Vantiv is also still considered the leader in the facilitation space.

With the significant rise of SaaS platforms offering embedded payments there has also been an increase in the number of acquirers offering a payment facilitation solution as well as technology plays to improve areas where traditionally the legacy acquirer platforms have weaknesses [eg chargeback management and funding]. The best Payment Facilitator solution will depend very much on your goals. What is the best fit for you? That question can typically only be answered by having a conversation with experts in this field.

This makes for a very attractive time for SaaS platforms looking to leverage Payment Facilitation to become a PayFac to both drive new revenue streams and create a better end user experience.

Paypal/ Stripe/Square underwrite and provision the merchant accounts themselves and fund their sub-merchant’s payments. MOST importantly, PP, Stripe and Square assume the risks involved in payment processing. These include fraud loss, chargebacks and non payment.

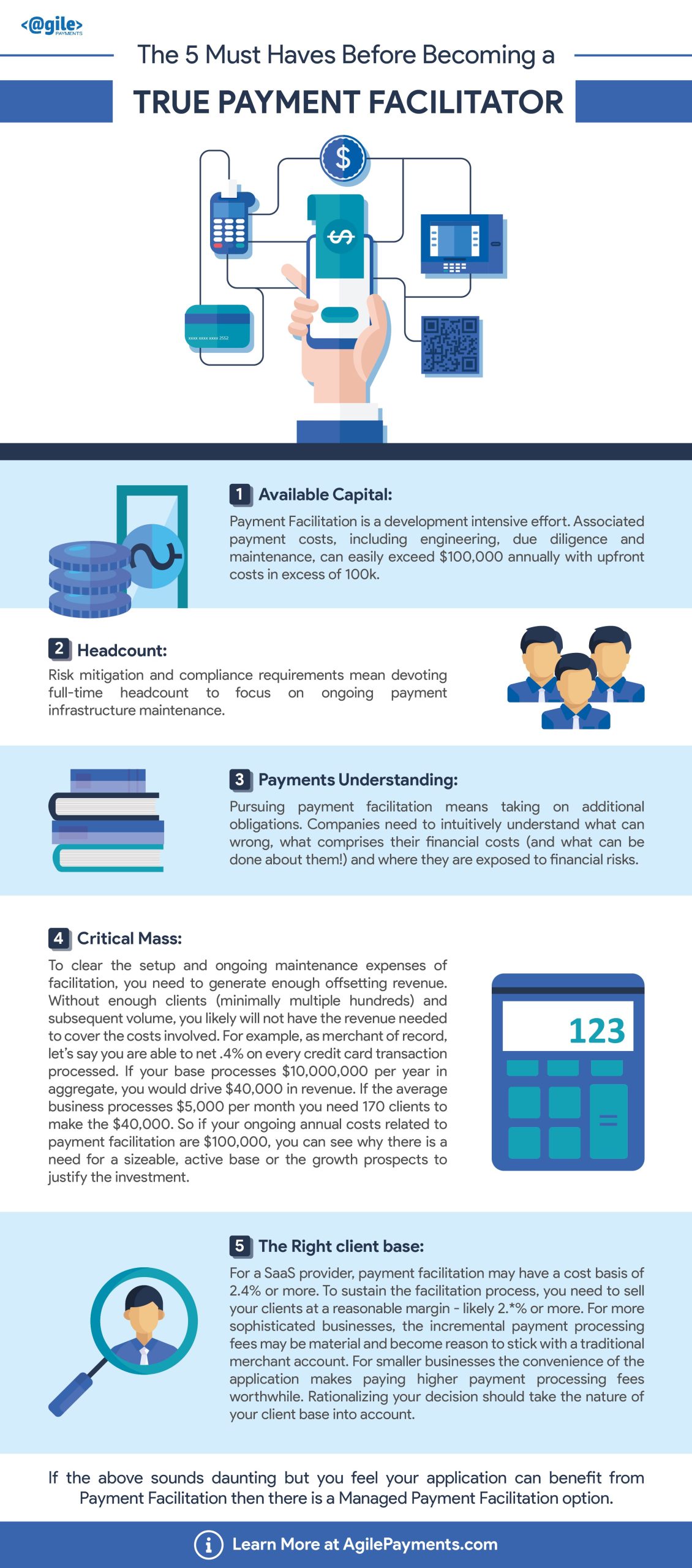

Because of these risks and more [eg money laundering] there is a tremendous amount of money, work, scrutiny and compliance to becoming a true Payment Facilitator.

A traditional ISO (Independent Sales Organization) merchant account provider will obtain information from the business owner that makes them comfortable enough to assume payment risks. This could include voided check, bank statements, copies of business license, personal license and more. The back end payment processor is essentially taking on one merchant at a time that they can approve or deny services to based on underwriting process.

As a Payfac, these friction points are removed and much of the customer vetting process is automated via API calls.

One of the biggest advantages that Payment Facilitators have is their ability to set up a new customer almost on the fly as opposed to the merchant account provider that may take days or even a week or more to approve an account. There is then additional time ensuring the payment gateway or application using the payment processing has all the appropriate merchant account credentials provisioned. The Payment Facilitator model eliminates these issues as well.

In the past the only option for a SaaS platform was to become a full fledged PayFac, meaning registering with MasterCard + Visa, spending tons of money and time getting your Payment Facilitation application approved, integrating and creating a team to mitigate risk and compliance demands. By tons of money think $100-200k+ in startup and legal costs. Annual costs for compliance and risk mitigation may be in the 100k per year range.

Technology and rules change frequently and a new option has emerged that offers SaaS platforms the vast majority of the benefits of true Payment Facilitation without the massive expense and integration demands.

In the Hybrid PayFac or Managed Payment Facilitation model you are in essence a sub PayFac. There, a true PayFac that assumes all those compliance and regulatory and infrastructure costs. They have created a platform for you to leverage these tools and act as a sub PayFac. They have a lot of insight into your clients and their processing. This level of insight mitigates much of the risk that Vantiv for example faces after approving a platform to act as a true PayFac.

For the vast majority of platforms it simply makes little sense to become a true Payment Facilitator.

The question then becomes: “Why go down the true PayFac pathway?”

The The Managed PayFac model does have a downside. In the true PayFac model a client at that medical office sees “My Medical” on their credit card statement. In the hybrid model if your Master PayFac is YourPay for example you would see “YPY* My Medical” on their statement [descriptor] where YPY* indicates YourPay as master PayFac. This may not be an issue or it may depending on your business model.

Another reason to act as the true PayFac is you own the payment process and that customer. There is no one in between or involved. Certain business may value that. Especially if you are positioning your application to be acquired. Even then the Managed PayFac model may still offer better solution.

First the disadvantages to the Payment Facilitator model.

What can go wrong with Payment Facilitation blog post

The advantages to the Payment Facilitator model

How does a Software Platform make money from Payment Facilitation?

Revenue is derived simply from the difference in buy rate from the processing networks and the sell rate charged to the end customer. For illustration, if a Payment Facilitator knows their true overall cost amounts to 2.4% of processed volume and they sell at 2.9% their margin is .5% of dollars processed. If they process $10,000,000 per day that works out to $50,000 in revenue per day. Very attractive business model and you might say sign me up.

Not so fast!

There is still the risk exposure that must be examined. Any business that chooses the PSP model will likely face loss from fraud, going out of business, non-fee payment, etc. It is possible an end user signs up for your SaaS offering with the intention of committing payment fraud–it does happen. They are enrolled in your ecosystem and process $10k or even $100k using stolen card data. Who is on the hook for that loss?

If you suspect it’s you and your application you would be spot on. Going into payment facilitation without an understanding of your risk exposure is a fast way to lose your shirt. Mitigating risk and using technology to identify potential fraud is massively important. Your facilitation partner should provide automated risk assessment tools that minimize your exposure. These tools will do most but not all of the user vetting. You still need to know your customer and be aware especially when first onboarding of potential fraud. Most payment facilitation platforms offer controls to measure velocity, funding, reserves etc.

Payment Facilitation Providers – What to look for

In addition, small dollar average ticket merchants that do very few transactions per month are typically not profitable. A merchant that does three $40 transactions per month might generate $4 in revenue. If acquisition, boarding and support cost an average of $40 per merchant, the ROI is almost a year to break even. So thought must be given to your target user base: Do we have enough users so that payments volume will generate ROI?

As the Payment Facilitator you will also be front line for payment related support and when money is on the line you know people want service ASAP. There must be thought given to the support burden when pursuing the PSP model. The more you “know” your client base and the potential for dollar loss the more informed your decision will be. Thought should be given to documentation and support systems that allow for as much self service support as possible.

So it for you? Definitely a decision your business needs to give a lot of thought to. If fast/easy client boarding is a must the PSP model is very tough to beat. There is of course the risk mitigation that MUST be addressed. There are certainly cases where payment processors have gone down because they did not properly mitigate exposure. Customer service burdens are also a part of your decisioning. Typically you will also have an integration timetable to ensure the account provisioning, application process and KYC [know your customer] obligations are programmatically correct.

It is also very much a numbers game. Your hard costs should be explored up front. Integration, compliance, support, admin costs should all be looked at.

Once you have an idea about costs it’s now about:

Run the numbers and decide how many clients it will take to break even. You should know both your client acquisition costs and lifetime value. This will provide insight as to whether going down the Payment Facilitation road makes sense.

After you have decided what Facilitation solution is the best fit your next steps vary.

Full blown Payment Facilitator

1-Register w/Sponsor Bank. The Sponsor bank/processor [eg Vantiv] underwrites your business for their potential risk [fraud, negligence, reputational]. You and your business will be vetted to ensure all seems on the up and up. Think applying for a very large mortgage.

2-Approval by Sponsor. You are officially approved and move on to integration/testing. You will want to be thinking about compliance [PCI/KYC] options as well as ongoing risk mitigation.

3-Technology platform integration: You make sure data flow, onboarding, funding risk controls are all in place and operating

4-Sponsor bank issues credentials to make systems live.-you have your Payment Facilitator license. Now for testing –moving real money around to monitor flow and system performance.

5-Go to market. The fun part-you either batch onboard current clients or turn on customer acquisition tap.

6-Refine. You will learn a LOT in first weeks/months. What is working and what needs changing.

Start to finish this can take 6+ months and significant $ investment – easily $100k+

If all of that seems too much time, effort and money then you consider Managed or Hybrid Payment Facilitation. In this model the path to facilitation is less onerous. You can sign contracts, integrate, test and go to market in as little as 3 weeks.

As you might suspect there is a catch, and that is your profit margins might be reduced.

Why? You are acting as the sub Payment Facilitator. You need to make money and the master PayFac needs to make money.

This does not necessarily have to be the case. Much is dependent on the applications: a-potential volume b-perceived risk exposure and c-company’s financial strength and other factors.

So don’t discount this pathway-it can be a very attractive middle ground. In fact in all but a few cases the Managed PayFac model is the better option and in the case of less mature application it is often the only true solution.

There is also a third alternative to becoming a Payment Facilitator while still being able to offer fast account set up. You may find a Third Party Processor with slick API’s for merchant account onboarding that offers a hybrid blend between traditional re-selling merchant accounts for a TPP and acting as a Payment Facilitator. Advantages are no risk, no support and much lower implementation costs. You still gain revenue benefits without admin burdens. It is unlikely you would be able to provision accounts as quickly as if acting as the PSP, but this may be the best fit for you. Especially if you want to focus on your core product but realize payments can play an important role is business growth [and revenue generation].

In summary Payment Facilitation isn’t for everyone but that’s not what is important. The question is “Is it right for you”? That’s a question best answered by having a conversation with you guessed it: Agile Payments. Our strength is creating partnerships that help your business be more profitable.

There are multiple options for both full blown Payment Facilitation providers as well as Managed PayFac providers.

What to look for in a partner?

First and foremost: Do they understand what your goals are for both your application and end users?

Some providers are willing to provide the technology but very little insight or support. You are essentially left to figure things out. Adding more more complexity to your never ending list often means you delay getting to market. Your want an actual partner. Someone who is vested in your success, can offer insights that save you time and money and offer insight into your distribution channel. Possible connections are also a big plus.

Have a conversation. Most of the time you will have a connection with the right provider for you.

In a marketplace individual sellers are able to sell goods or services. The marketplace acts as the distribution channel and onboards sellers. Etsy is an example.

Very importantly the payment process is very different from Payment Facilitation. If someone purchases earrings on Etsy for $99 they will se Etsy on their credit card statement. Etsy is the Merchant of Record (MOR). Etsy processes the card and will typically fund the earring seller after deducting payment fees.

In Payment Facilitation the earring maker would have been onboarded as the sub merchant and the buyer sees “ABC Earrings” on their statement.

For most marketplaces processing payments is a revenue driver as there is margin between their cost to process the transactions and what they charge sellers.

So marketplace payment processing differs from Managed Payment Facilitation in that the platform takes on all payment responsibility for platform users. In true Payment Facilitation the platform also has sub user financial risk/responsibility.

Because there is more perceived risk in marketplace payment processing the cost basis is higher.

As an example a marketplace provider may have a cost basis of 2.7% and 20 cents. If they charge the standard 2.9% and 30 cents the margin is .2% and 10 cents.

As a Payment Facilitator costs might be 2.4% rather than 2.7% [both are examples only].

A property management firm specializing in condo and homeowner association applications needed to process monthly association fees on behalf of their many clients.

In this space it is common to have one entity manage many properties. Having those disparate associations apply for a standard merchant account can create significant friction. So much so that the application process could be a barrier to adoption.

By adopting the managed PayFac model they were able to instantly onboard associations and provide reliable payment solutions. All without significant time, money and risk.

In their case they went from discussions to integration and implementation in a matter of weeks.

If you are interested in exploring how Payment Facilitation benefit your platform the first step is a conversation with someone who will listen to what your goals are and that understands this a partnership where both parties must be fully invested in making your business successful.

Contact us today

You can get more detailed information from our Whitepaper: Payment Facilitation: Is it right for my business?

Payment Facilitation (we are referring to full-blown Payment Facilitation and not Managed) allows a platform to instantly onboard sub-merchants and enable payment acceptance. Eg Danceology has a software platform that makes running a dance studio simple. Accepting monthly payments from parents and reconciling those payments is an important component of the platform. Rather than having each studio apply for their own merchant account (time and labor-intensive), Danceology holds a master merchant account and allows the individual dance studios to easily obtain their own subaccount. Danecology assumes all compliance burdens and payment risk and funds the studios for payments owed. Danecology is underwritten to ensure they are “risk-worthy”. There is substantial costs associated with Payment Facilitation.Fundamentally Danecology transitions from a dance platform that allows payments to a payments company that serves Dance studios

Because of the significant costs and risks associated with full-blown Payment Facilitation the only businesses that are good fits are a: platforms with a large user base whose payment volumes drive enough revenue to make the costs and risks worthwhile. Again you are pivoting to becoming a payments platform

Foremost your profit margins are greater than Managed Payment Facilitation. The payment risk is on your Managed Payment Facilitation partner. This is mitigated by more revenue to the partner. Another reason may be to own and brand payments. Eg “Payments by Danecology”. If you are looking at a potential acquisition true Payment Facilitation may be for you.

Likely 3-6 month and possibly more. Significant resources (programming/compliance/risk management) will need to be allocated as well

customer, fraud, facilitator, risk, payment card, onboarding, underwriting, revenue, fee, regulatory compliance, chargeback, payment card industry data security standard, payment processor, know your customer, merchant account, merchant services, merchant account provider, bank account, payment gateway, debit card, customer experience, infrastructure, risk management, invoice, payment system, user experience, point of sale, acquiring bank, payment card industry, mobile payment, money laundering, contract, regulation, business model, online marketplace, retail, ecosystem, due diligence, emv, data security, payfac model, payment processors, payfacs, payfac, payment facilitator, accept payments, payment facilitators, payment processing, accepting payments, fintech, digital wallet, organization, customer service, intermediary, vendor, accounting, online shopping, income, financial institution, leverage, communication, software as a service, price, analytics, flat rate, innovation, consumer, risk assessment, credit card fraud, asset, procurement, license, complexity, brand, customer satisfaction, merchant, scalability, automation, fundraising, cash flow, software development, partnership, cash, card payments, independent sales, payment systems, electronic payments, skip to content, competitive advantage, brick and mortar, dispute resolution, revenue stream, food delivery, customer support, apple pay, payment terminal, pricing, wire transfer, ownership, credit, credit card processing, office of foreign assets control, liability, authentication, valuation, option, return on investment, issuing bank, encryption, knowledge, tokenization, audit, telephone number, recaptcha, service provider, payment infrastructure, payments revenue, funding, program, partnering, credit card payments, embedded payments, payment solutions, pci dss compliance, freedom, payment facilitation, facilitation payment, research, commerce, bribery, corporation, currency, transaction processing, landscape, law, acquirer, financial services

ach payment facilitationmanaged payment facilitatorhybrid payment facilitationpayment facilitation as a service