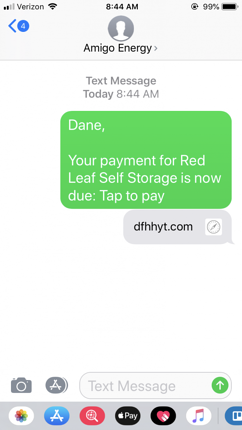

SMS payments, or Pay by Text payments, are a means of paying for services or goods via a mobile phone text message. The customer typically receives a text prompting them to initiate payment via a website interface or additional text messaging.

Almost any business that takes payments for goods or services can realize operational costs savings and an uptick in collected revenues by choosing to accept payments by text message.

Businesses can initiate SMS payment texts in a batch mode via file upload or by using an SMS Virtual Terminal.

SMS stands for Short Messaging Service, and centers around cell phone texting. SMS Payment Solutions allow businesses to:

Most people in the US and Canada have seen TV special or commercials asking for donations through text messages. A charitable organization like the Red Cross accepts donations via just text a message or number to make a $20 donation. Many charities have elected to accept payments by text message.

Businesses now realize paying by text offers benefits to both consumers and the business itself. With 98% open rates, 95% read rates it’s easy to see why SMS Payment Solutions are such an attractive customer billing option.

Using SMS, you are able to send a message of up to 160 characters to another mobile device.

Research conducted by TransparencyMarketResearch.com showed that SMS accounts for a majority of financial transactions conducted worldwide, and mobile payments conducted through SMS are expected to experience a YOY growth rate of over 28% and total $385 Billion in revenues.

Over 80% of Americans use text messaging, making it the top activity performed on a smartphone. Despite its popularity, most billing organizations ignore texting as a paperless payment channel. Any business dealing with late payment collection should consider a pay via text message solution.

Insurance companies, utility, telecom, financial lenders, the rent-to-own industry, property management and more can all realize significant operational savings, as well as collections uptick by utilizing an SMS Payment Solution. Payment collection via text messaging is a great way to offer customers convenience as well reduce payment collection costs.

Text to Pay solutions allow your customers to opt-in to receive a text message containing information (e.g. current balance and due date). Customers opt-in to either receiving pay by text messages or solely bill payment/late payment text reminders.

Your customers will appreciate the convenience of 10-second payments and your business will benefit from fewer delinquencies and shortened payment days outstanding.

While some businesses may prefer to automate the SMS process via a file upload or information push, others are better served by using an SMS Virtual Terminal or Pay by Text Virtual Terminal.

A customer service representive logs into a secure website. The website offers a dashboard allowing for easy navigation. This become the control center for originating texts and 2-way communication.

This secure website is the SMS Virtual Terminal. A business may have unlimited users. Admins can with limit permissions as well as view reporting based on an individual user.

An invoice text can be easily and quickly created, either by manually entering customer details or the customer base (or a subset) can be “loaded”.

The customer receives the text and can then interact with the cs rep by texting. The cs rep can take advantage of pre-made templates that address FAQ’s.

The customer clicks on a link to be taken to a secure page with the business’s branding + contact information. Texts are delivered to the customer from a local number that when called redirects the customer to the business*.

*Note that this is not common in SMS Virtual Terminal Payment Solutions

Consider a medical practice using an SMS Virtual Terminal. The patient arrives and while still in their car can text the office notifying their arrival. A cs rep can engage the patient and address pre-office needs PLUS collect a co-pay. All with no face to face contact.

A very important part of collecting payments is reconciliation. If you were part of a multi-location medical group with centralized billing and collections the ability to recognize revenue to the appropriate location is very important. So much so that without a way to do this the convenience of the new SMS Virtual Terminal payment collection tool is mitigated by the extra accounting work.

Our Pay by Text Virtual Terminal offers the ability to establish hierarchies. Once the cs rep is in Virtual Terminal they can simply choose which location the payment should be recorded to.

For more information see our 2020 Guide to SMS Payment Solutions

An auto insurance company implemented an outbound SMS payment | Text payment collection program.

When the premium payment was 2 days day late a text was sent to the customer advising the payment was due as well as the importance of continued coverage.

A second outbound text to pay was sent when payment was a day late.

The insurance company simply securely uploaded a csv file from their billing system containing relevant policy and customer information. The text contained instructions on how to make payment.

If the customer had already opted into the text to pay solution they could simply use the securely stored payment method. If a new user they were walked through the payment set up.

As part of the SMS payment solution, a settlement file with relevant details is made available to the insurance company, allowing them to reconcile payments in an automated fashion.

Significant decrease in live collection calls were realized as well as a drop in policy cancellations.

Both of the above resulted in reduced labor costs as well as the costs involved in policy cancellations. All from an easy to implement Pay by Text solution.

The improvements in operational efficiency result in higher profit margins. Better collection rates improved cash flow.

Every provider should offer data security and PCI compliant SMS payment solutions. Here are 7 more things to look for from your SMS Payment Partner:

SMS payments, or Pay by Text payments, allow paying for services or goods via a phone text message. The customer typically receives a text prompting them to initiate payment via a micro-site or additional text messaging

SMS Payments are quick and easy to use. People almost always have their phones nearby. Think about your text open rate versus your email

After initial setup, there is no need to have a payment method on hand – it is already saved in our secure environment

Really any business that has late payments or likes to send payment reminders. Pay by text solutions typically outperform traditional solutions by a wide margin

Depending on the complexity there may be a set up fee but typically you will have a monthly fee plus your per payment fees.