Push Payments — Removing risk from the payments paradigm: How businesses can benefit from consumer permissioned payments | PushPayments to eliminate chargebacks and payment declines.

Outline:

What are Push Payments?

Think about how you currently pay when checking out online at Home Depot. In every checkout scenario Home Depot is charging your credit or debit card and “pulling” (debiting) money from your account.

It is very important to understand the money flow. Most people assume that money travels directy from their credit card to Home Depot’s bank account. What really happens is that the payment processor Home Depot has partnered with receives the sale proceeds and then in turn funds Home Depot’s bank account. So there is always a bank or payment processor “in the middle.”.

Every transaction Home Depot processes could potentially result in a chargeback. An example would be the item arrived damaged and you could not get a refund. You might call your card company, explain the situation and see if they will credit your money back.

Once done the property management application can check balance, payment history etc. They can also future check bank account balance before a debit, thereby reducing NSF risk.

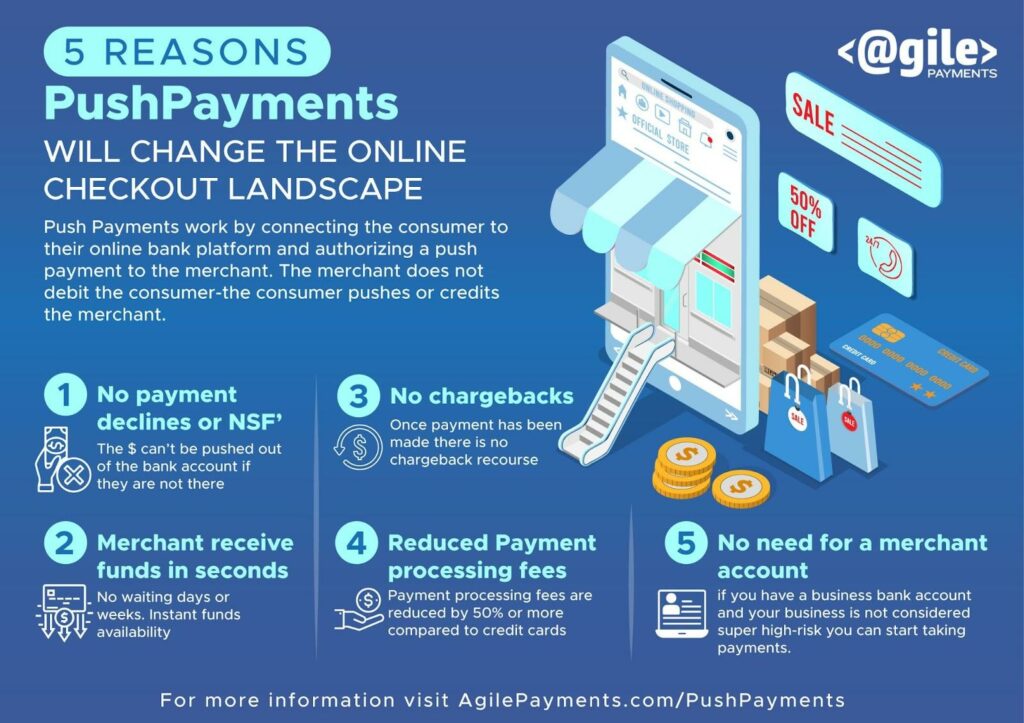

New technology takes this one-step further and once the consumer connects their bank account they are then presented with an option to push or send the payment from their bank account. These PushPayments run on the same network as Zelle or PopMoney network rails and uses Real-Time Payments (RTP).

***Note: The PushPayment Solution we are discussing is geared to non-face to face transactions. PushPayments do have a use case for Point of Sale transactions.

What are Real-time Payments (RTP) and how do they differ from traditional payments schemes?

First, in contrast to ACH processing, RTP supports credit or push payments only. There is no ability to debit another bank account using RTP. The core RTP functionality is that it enables instant funds transfer.

This instant settlement eliminates payment failures due to insufficient funds, which is relatively common in the ACH world. When a business uses ACH processing to debit a customer’s bank account for a regular payment and that bank account doesn’t have the requisite funds, their bank sends the ACH network notice that the debit was returned NSF. This NSF notice can come back 72 hours after the payment is processed. Because RTP’s are creditor push payments, there is no risk of payments failing due to insufficient funds.

Do you see how both chargebacks and payment failures can’t happen? You can’t go to your bank and say “I sent them money. Uhh–it was an accident”. So the risk of a chargeback is zero. There is current scrutiny especially around Zelle regarding fraudsters tricking people into sending $ via Zelle. As of now, there is still no recourse for “pulling back” any missing $.

Your bank won’t let you send money you don’t have in your account so payment declines are eliminated as well, meaning no possible NSF.

The technology also eliminates the need for a merchant account. As long as a business has a bank account they can receive push payments from their customers.

RTP also allows more transactional data to be revealed with each payment. For example, a marketplace like Etsy could include details about the item sold like the seller and purchase ID. An accounts payable or bill pays solution could include the invoice number on payments sent.

Unlike ACH and Wire Transfers which don’t operate on weekends, bank holidays and outside business hours the RTP network is always ON.

All RTP payments are processed by The Clearing House. If you pay your monthly electric bill using RTP, your bank messages the RTP network and includes the details of the payment. The Clearing House processes the payment message and routes it to the electric company’s bank, thus irrevocably completing the payment. RTP uses the ISO-20022 standard for the messaging used to initiate payments and retrieve transaction status.

Fundamentally a PushPayment solution or Consumer Permissioned Payment Solution connects the consumer’s payment directly to the business bank account. Again we compare to a traditional payment processor where the processor is ALWAYS in the middle of the payment $ flow.

Traditional: Consumer is debited $100—–>Processor receives $100—>Processor pays out end merchant $100

Push Payment Solution: Business “requests” payment from the consumer (typically via QR code)–>consumer “pushes” payment to the business via online bank interface→Business receives $ in seconds

Drawbacks of RTP

On the evidence of what you have read so far you have to conclude that RTP solves a LOT of problems for businesses, both low and high risk.

So what are the problems?

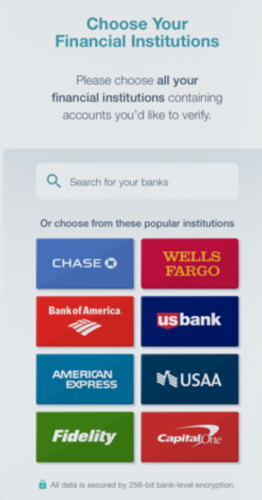

1-Not every bank participates in RTP. Smaller bank and CU’s are typically slower to roll out technical changes. Every bank is eligible but only around 60% currently leverage RTP. If your bank does not offer the ability to connect your bank account to an application via a Plaid/Yodlee/MX etc then they are definitely not using RTP. There will certainly be wider adoption. For a list of RTP participants click here

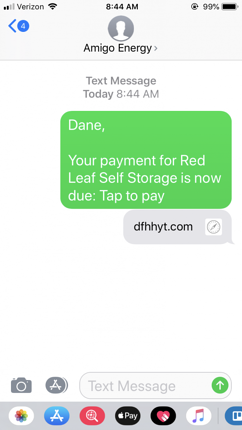

2-Recurring AutoPay payments can not currently be “set and forget”. In the ACH world you can debit the customer on the 1st and every month their bank account is debited like clockwork. RTP is more suited to one-time payments though you can certainly message the customer via email or text prompting them to pay via RTP. This process is built into RTP and uses RfP technology. RfP means “Request for Payment” and essentially texts the customer asking them to click here to make your payment

3-Relative to ACH processing RTP payments are likely more expensive than ACH. Pricing will depend on many variables. In the ACH world you might pay 30 cents a transaction or less. Using RTP you are more likely to be 50 cents up to $1.00 or more. Depending on your customer base and risk level you have to decide if the speed and payment finality of RTP offers your business ROI

4-Finality of payment. Yes, the thing that makes RTP so attractive does present challenges. Your refund policy must be looked at and possibly modified. There is no chargeback recourse like both ACH and credit card world offer. This makes having clearly defined policies paramount.

What is the consumer experience (UX) using RTP?

Consumers use a pay-by-bank option by scanning a QR code at checkout. The option could also appear to consumers as a button within their mobile banking apps. For security, the technology “tokenizes” user account information. Through their online banking portal the consumer securely authorizes the payment to be pushed to the business they wish to pay.

PushPayment | Consumer Permissioned Payments Use Cases

Why are PushPayment | Consumer Permissioned Payments the answer for high-risk business payment needs?

High-risk businesses can almost always obtain a business bank account. What is problematic and challenging is obtaining a merchant account. Traditionally a high-risk business would apply (usually multiple times) to obtain a conventional merchant account. By conventional, we are referring to accepting credit card payments via debiting the consumer’s card.

Oftentimes a $ reserved is collected up front to mitigate chargeback risk. Other measures to mitigate risk might be weekly or bi-weekly payouts. By paying out less frequently the payment processor reduces chargeback exposure. Chargeback ratios are typically capped at 1% and overage can mean your account is terminated. This often creates a hamster wheel of trying to obtain another merchant account.

PushPayment | Consumer Permissioned Payments solve this problem in a singularly unique way.

THERE IS NO MERCHANT ACCOUNT

No merchant account means you can’t be cut off or terminated (assuming you are a legitimate business). This can seem hard to wrap your head around because it is so different from traditional payment solutions..

PushPayment FAQ’s

PushPayment Security Measures

As with all payment processing models, security and privacy are paramount. PushPayment providers must maintain the following standards when handling sensitive information during the payment process:

1-Encryption of consumer data at every point in the transaction process.

2-Online banking credentials are encrypted using

3-Your PushPayment partner NEVER stores consumer data. This means no data is exposed at any time.

4-Your PushPayment partner performs an internal audit after each transaction and generates a token (a token is a string of alpha-numeric characters that replace a full credit #).

5-This token is a digital attestation of consumer permission, the transaction receipt, and security audit.

6-Your PushPayment partner empowers consumers, regulators, and lawmakers to see exactly how data is being handled.

If you feel your business can benefit from Push Payments let’s have a conversation. Contact us now|

SMS stands for Short Messaging Service, and centers around cell phone texting. SMS Payment Solutions allow businesses to:

Most people in the US and Canada have seen TV special or commercials asking for donations through text messages. A charitable organization like the Red Cross accepts donations via just text a message or number to make a $20 donation. Many charities have elected to accept payments by text message.

Businesses now realize paying by text offers benefits to both consumers and the business itself. With 98% open rates, 95% read rates it’s easy to see why SMS Payment Solutions are such an attractive customer billing option.

Using SMS, you are able to send a message of up to 160 characters to another mobile device.

Research conducted by TransparencyMarketResearch.com showed that SMS accounts for a majority of financial transactions conducted worldwide, and mobile payments conducted through SMS are expected to experience a YOY growth rate of over 28% and total $385 Billion in revenues.

Over 80% of Americans use text messaging, making it the top activity performed on a smartphone. Despite its popularity, most billing organizations ignore texting as a paperless payment channel. Any business dealing with late payment collection should consider a pay via text message solution.

Insurance companies, utility, telecom, financial lenders, the rent-to-own industry, property management and more can all realize significant operational savings, as well as collections uptick by utilizing an SMS Payment Solution. Payment collection via text messaging is a great way to offer customers convenience as well reduce payment collection costs.

Text to Pay solutions allow your customers to opt-in to receive a text message containing information (e.g. current balance and due date). Customers opt-in to either receiving pay by text messages or solely bill payment/late payment text reminders.

Your customers will appreciate the convenience of 10-second payments and your business will benefit from fewer delinquencies and shortened payment days outstanding.

While some businesses may prefer to automate the SMS process via a file upload or information push, others are better served by using an SMS Virtual Terminal or Pay by Text Virtual Terminal.

A customer service representive logs into a secure website. The website offers a dashboard allowing for easy navigation. This become the control center for originating texts and 2-way communication.

This secure website is the SMS Virtual Terminal. A business may have unlimited users. Admins can with limit permissions as well as view reporting based on an individual user.

An invoice text can be easily and quickly created, either by manually entering customer details or the customer base (or a subset) can be “loaded”.

The customer receives the text and can then interact with the cs rep by texting. The cs rep can take advantage of pre-made templates that address FAQ’s.

The customer clicks on a link to be taken to a secure page with the business’s branding + contact information. Texts are delivered to the customer from a local number that when called redirects the customer to the business*.

*Note that this is not common in SMS Virtual Terminal Payment Solutions

Consider a medical practice using an SMS Virtual Terminal. The patient arrives and while still in their car can text the office notifying their arrival. A cs rep can engage the patient and address pre-office needs PLUS collect a co-pay. All with no face to face contact.

A very important part of collecting payments is reconciliation. If you were part of a multi-location medical group with centralized billing and collections the ability to recognize revenue to the appropriate location is very important. So much so that without a way to do this the convenience of the new SMS Virtual Terminal payment collection tool is mitigated by the extra accounting work.

Our Pay by Text Virtual Terminal offers the ability to establish hierarchies. Once the cs rep is in Virtual Terminal they can simply choose which location the payment should be recorded to.

For more information see our 2020 Guide to SMS Payment Solutions

An auto insurance company implemented an outbound SMS payment | Text payment collection program.

When the premium payment was 2 days day late a text was sent to the customer advising the payment was due as well as the importance of continued coverage.

A second outbound text to pay was sent when payment was a day late.

The insurance company simply securely uploaded a csv file from their billing system containing relevant policy and customer information. The text contained instructions on how to make payment.

If the customer had already opted into the text to pay solution they could simply use the securely stored payment method. If a new user they were walked through the payment set up.

As part of the SMS payment solution, a settlement file with relevant details is made available to the insurance company, allowing them to reconcile payments in an automated fashion.

Significant decrease in live collection calls were realized as well as a drop in policy cancellations.

Both of the above resulted in reduced labor costs as well as the costs involved in policy cancellations. All from an easy to implement Pay by Text solution.

The improvements in operational efficiency result in higher profit margins. Better collection rates improved cash flow.

Every provider should offer data security and PCI compliant SMS payment solutions. Here are 7 more things to look for from your SMS Payment Partner:

Push Payment Solutions enable a direct payment from a consumer/business to a business. This can via a push to debit card or using the Real-time payment rails a direct bank account to bank account payment. This differs from traditional payment processing where funds are debited from the consumer/business then settle into the payment processor’s account and then in turn are credited to the business

Because the money is being pushed rather than pulled, there is no possibility of a-payment error or b-chargeback. This eliminates two of the biggest challenges when debiting accounts

Any business that feels that payment errors, eg NSF, closed accounts or chargebacks are a problem. Typically you will need to be a low risk business. Because of the lack of dispute resolution Push Payment participants are highly scutinized