Topics:

Interactive Voice Recognition, commonly abbreviated IVR, is computer technology that replaces human interaction within call centers. Put simply IVR offers automated Secure Payment by Phone Business phone systems can offer voice prompts that route calls to an IVR system that would otherwise be handled by live customer service operators. IVR systems can handle huge loads of calls that would otherwise require enormous staffing to accomplish what an IVR system can handle. Offering secure Telephone Payment Solutions can significantly reduce workload while at the same time improve cash flow. The integration of modern payment gateway technologies allows credit card and ACH (eCheck) transactions to be accepted and processed using the IVR technology. This integration of technologies enables a business or organization to accept receivables in an automated fashion, without human interaction. Almost any business that accepts payments can benefit from a secure IVR automated phone payment system.

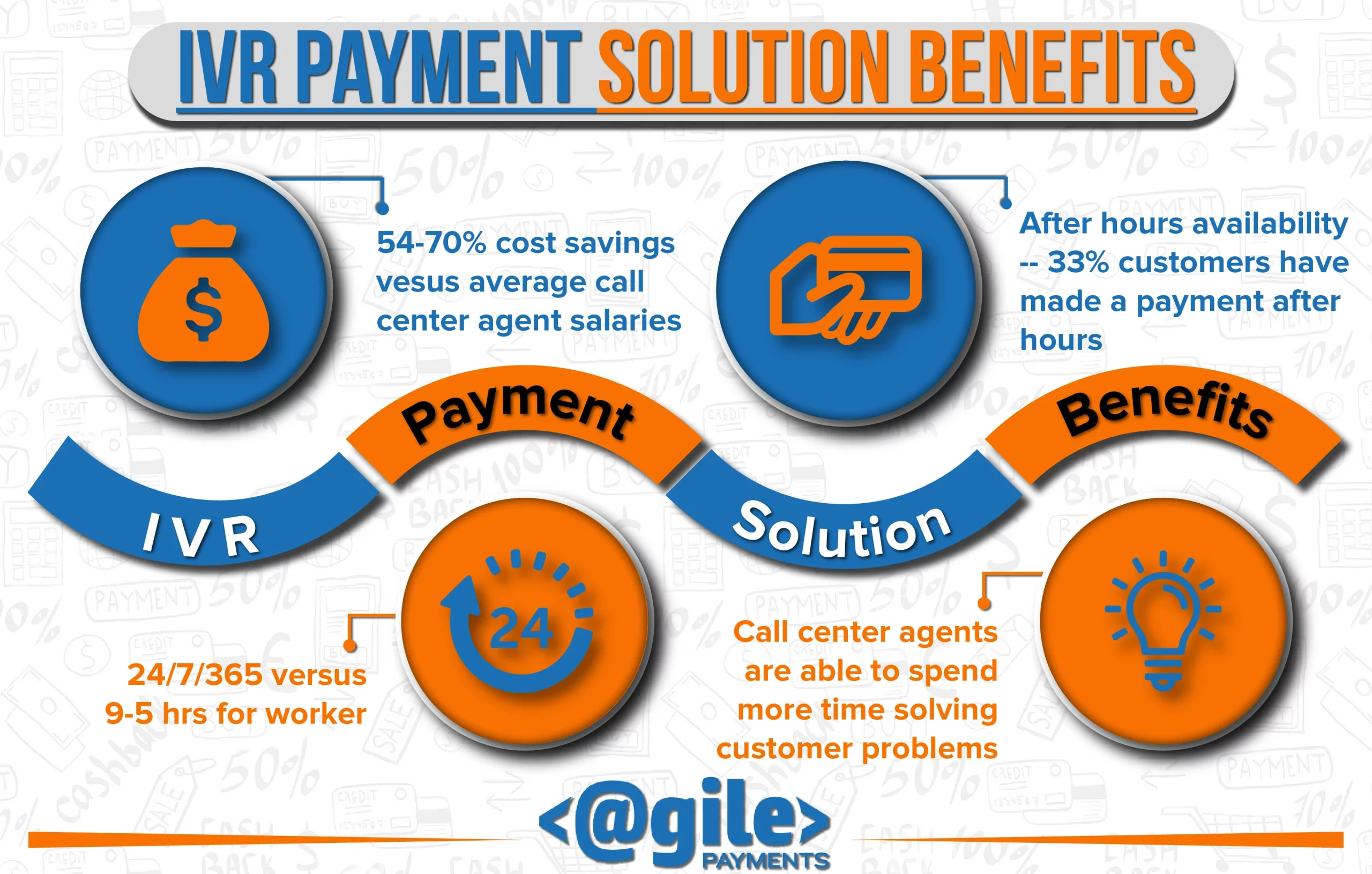

An IVR Payment System or Telephone Payment System, can make it easy for your customers to make payments and eliminate loads of man hours accepting payments over the phone using traditional methods. Some of the benefits of IVR Payments | Pay by Phone:

With the Agile Payments interactive voice response (IVR) system, customer service time spent answering phone calls and entering transactions manually can be eliminated. Customers no longer have to wait on hold waiting for a customer service rep to answer, improving timely payments and providing better customer satisfaction. Payment via Phone solutions make your customer experience better. Here are top 3 things to look for in your IVR payment partner.

Virtually any organization who has receivables or collects donations can benefit from an IVR payment solution, and new use cases are being discovered all the time. In one case a marketplace organization employed IVR for the purpose of capturing cart abandonment opportunities, where upon a successful call the IVR system completed a new customer payment via the IVR payment gateway integration. Almost any business that accepts customer payments can realize significant cost reduction around late payment collection via IVR Payments. Here a just a few industries that have realized the benefits of a Pay by Phone Solution:

Inbound: By far the most common type of an IVR call is where a customer is calling into a company or organization, and as it relates us what Agile Payments provides, wants to make payment over the phone. Outbound: Where the IVR system calls out to a company’s customers. A good example of an outbound call might be for late or forgotten payments that need to be made by a customer. SMS Payment Systems: IVR systems can text message a company’s customers. When a text message is received the recipient is prompted to reply via text in order for an outbound IVR call to be made. Email: As in the above SMS case, email messaging can also trigger outbound calls via a reply.

IVR phone payment transactions can be reported in real-time using API callbacks and updates to the transactions in near real-time using API webhooks. Reporting integration to organizational specific software platforms can be accomplished by using our API webhooks and/or callbacks. Webhooks postback transactional messaging from the IVR payment originations to server-side endpoints that the organization define. These messages can be used to track transactions that are disputed, maintain customer payment information via reference tokens and provide updates on transaction status for reconciliation and account updates. Automated delivery of phone payment reporting can also be configured to be delivered to a single or group email address or posted to an sFTP site.

Agile Payments IVR payment systems can provide a business or organization that ability to accept both IVR credit card transactions and IVR ACH (eCheck) transactions. Customers can make payment by phone quickly and without need for manpower. Organizations and merchant companies can choose to open a merchant account for credit card processing in conjunction with the IVR payment system. Processing rates can be configured on a flat rate basis or, more ideally for the merchant organization, on an interchange plus basis – giving the merchant organization a solid understanding that all credit card transaction will be charged at whatever the interchange table rate is for a given card type. eCheck payments are nothing new, having been around for a long time. ACH payments now exceed a total volume of $40 trillion. If you have made monthly AutoPay payments for your mortgage or paid a credit card bill, those transactions were via eCheck (ACH). By having eCheck transactions available in your IVR payment system, you are able to process payments much more economically than when processing payments via credit card transactions. If your organization decides to implement consumer convenience fees on the payment transactions, eCheck convenience fees can be much more palpable to your calling customers than credit card convenience fees. This is because convenience fees can be configured differently for the two payment modals. For example, for a $250,00 payment, an eCheck convenience fee might be configured to charge the caller a flat rate of a few dollars, where a credit card convenience fee would require around $7.50 to cover the processing costs. And as the dollar amount of the transaction gets higher, the more a caller has to pay for the convenience fee for a credit card transaction, where the eCheck convenience fee remains at the flat rate. If your organization already has an existing credit card merchant account, it is possible to utilize our IVR payment system. Our gateway transmits to most all back-end credit card processors. This gives us the ability to utilize our value-add products like the IVR system | Telephone Payment Solution and process your transactions. To enable this, the merchant organization would register for a gateway-only account in addition to the IVR Payments account. In this case the merchant organization would be required to pay a per transaction gateway fee in addition to the small monthly support cost. You would also receive a virtual terminal login where you can pull reporting data for the credit card transactions. If an organization requires an eCheck processing account, this can be done in addition to the gateway account by adding an ACH merchant account.

It has become common practice for businesses to charge convenience fees for IVR payment | Pay by Phone transactions. Convenience fees can be applied to both credit card transactions and ACH transactions. The choice as to whether to utilize the convenience fee option is completely up to the merchant organization. For some, it’s a good fit, for others perhaps not. For example, a religious organization might have a hard time justifying the inclusion of a convenience fee, while a utility company might not. What it does provide organizations who choose to include convenience fees is what can amount to an offset in processing costs that can eliminate the costs completely.

We provide a few flavors of IVR payments systems. The choice is mostly driven by the capabilities of the adopting merchant organization. In some cases the  adopting organization wants the configuration to be handled completely by us. In other cases the merchant organization will want the ability to configure the setup themselves and be able to make edits as organizational changes might be made. There’s also a third option where we can initially configure thing, but still give the merchant organization access to what is there dashboard workflow. In the hand-off approach, a discovery call is had with a product specialist to gather information. All configurations are done by us and the customer must contact us for any changes. This approach requires a setup fee, beginning at $500. In the hand-on approach, the customer is granted access to an online workflow dashboard where they can visually configure their workflow using pre-made modules or custom modules to suit their needs. Click for information on IVR Phone Payment Security

adopting organization wants the configuration to be handled completely by us. In other cases the merchant organization will want the ability to configure the setup themselves and be able to make edits as organizational changes might be made. There’s also a third option where we can initially configure thing, but still give the merchant organization access to what is there dashboard workflow. In the hand-off approach, a discovery call is had with a product specialist to gather information. All configurations are done by us and the customer must contact us for any changes. This approach requires a setup fee, beginning at $500. In the hand-on approach, the customer is granted access to an online workflow dashboard where they can visually configure their workflow using pre-made modules or custom modules to suit their needs. Click for information on IVR Phone Payment Security

As with configuration, there are two choices in how a merchant organization can populate data to be used by the IVR payment system. The choice here is largely driven by the technological capabilities of the merchant organization. In the hand-off approach, system data population is uploaded by a csv file that is based on a template we provide. Data fields that can be used below. R = required, O = optional:

The funding report can show and report to a merchant the date that funds posted to their bank account and how each transaction that makes up the funding (be it sale, refund, return, chargeback). A unique descriptor is assigned to their bank statement that can be used in an online portal or via API to search for the funding. Read more about Payment Reconciliation.

Agile Payments can provide an additional inbound payment method that works in conjunction with the IVR payment system. The product is called Bill Pay and is a web based billing and invoice lookup and payment tool. This Bill Pay system allows a merchant organization the ability to populate billing data in the same fashion as the IVR system, via csv file upload. In many cases the same file can be used to populate both systems. Various setup configurations can be accomplished such as what field data can be searched in order to locate a bill or invoice or forcing older outstanding invoices to be paid first. Payments are all originated in a PCI compliant and certified platform, greatly reducing the merchant organization’s PCI scope. And as with the IVR payment system, many, if not all, or the benefits are applicable to the Bill Pay system, including the ability to leverage consumer convenience fees to offset processing costs.

Here at Agile Payments, we’re here to listen to your use case, how you’re currently handling your inbound payments and how we might best be able to configure an IVR or Bill Pay system to reduce and eliminate your man hour workload involved in your current environment. If we don’t think our system meets or exceeds your needs, we will be the first to say so. Contact us today to schedule a consultation on your inbound payments needs. IVR payment systems inquiries are routed to senior staff, all having over 18 years of payment processing experience, having provided processing solutions to organizations of all sizes – from fortune 50 to small business.

FAQ’s