An Electronic Bill Presentment and Payment System offers businesses the ability for customers to obtain applicable bills/invoices and make payment via ACH and/or credit card. Electronic Bill presentment and Payment (EBPP) enables bills to be created, delivered, and paid via the Internet on computers and mobile devices. EBPP has applications for multiple industries, from utilities, insurance companies to any business looking to streamline operations and offer self service customer payment options. Depending on the businesses electronic invoice presentment and payment solution needs, bills or invoices may be delivered to the customer by email with a link to make payment to that bill or in more sophisticated solutions the customer can create an account where their invoices can be viewed, paid and an audit trail created. The BillFind+Pay electronic bill presentment and payment system provides companies and organizations a web based system that allows customers to lookup their payables by entering in account related data, e.g., Invoice Number, Account Number or other merchant definable fields. Billers upload Bill Definition files using sFTP that contain customer receivable information and direct their customers to the BillFind portal. Merchants can choose to accept Credit Cards, eChecks (ACH) or both as payment vehicles. BillFind+Pay differs from an electronic invoice that is generated and delivered to customers in that the customers lookup their bill themselves, and once located they make payment. EBPP can work in concert with IVR Payments, including outbound calls and SMS messaging. SMS messaging can prompt either a payment page that renders on a mobile device or, a reply to the SMS message can trigger an outbound IVR call. All of these capabilities work alongside the EBPP web rendered solution. Additionally, SMS Payments can provide another option for electronic bill presentment and payment. Text messages can be delivered to customers that present their invoice amount that is due and provide the option to pay from a mobile device where the text message redirects the customer to a micro payments site. The customer receiving the SMS invoice can also reply to the message “call,” which triggers an IVR system to initiate an outbound IVR call where the payment can be completed over the phone.

The bill presentment and payment system can be used in concert with the IVR Payment system. Both systems are designed to streamline the receivable process and reduce man hours required to process and originate receivables. Organizations and businesses that accept payments over the phone using customer service employees can find a huge reduction in man hours.

As you evaluate a bill presentment provider make sure you have the following available features:

The Bill Presentment and Payment system can be used with and existing merchant account. If you do not have an existing credit card merchant account, one can be provided. To use the system with eChecks, we must provide that portion of the processing account.

The Bill Presentment and Pay solution from Agile Payments utilizes a csv template for the purpose of populating the customer data in order for them to locate and remit payments for all outstanding invoices related to their account. Partial payments can be accommodated via a specific csv file template. Billing companies simply provide a menu item and url on their website which directs their customers to the hosted Bill Presentment and Payment site. Billing organizations have their choice as to what searchable fields are available. In some cases a billing company might only want to make available account number for locating an invoice. In other cases a billing company might want to make available name search, phone, email or more.

Aside from the benefits of reducing invoice delivery costs and customer service time spent on payments related phone calls, an EBPP system can present marketing and sales messaging in a more effective manor than paper invoices could ever hope to do. Engage your customers with interactive marketing messages and videos that can’t be done with traditional paper invoice delivery.

Depending on the Electronic Invoicing that the prospective client is interested in, data population can come from one of two different options:

No matter which option is adopted, an EBPP system that allows self-service for customers to locate and pay their invoice, 24/7/365 can significantly reduce their customer service workload – and the need to send out invoices, whether it be electronically or traditionally.

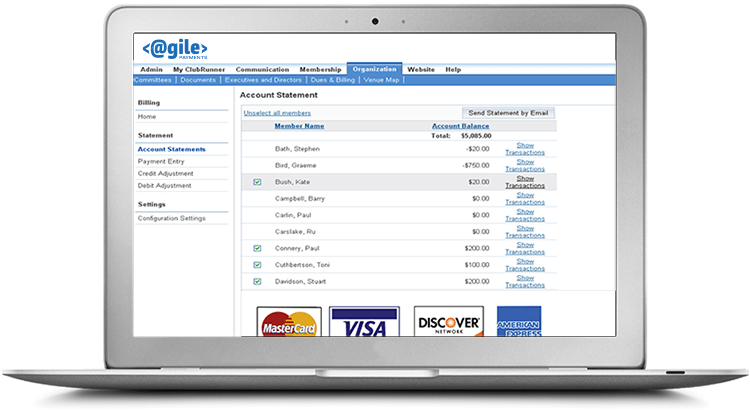

There are many available options for reporting of transaction originations, status, rejected items, settlements, deposits and future transactions:

Integrating Webhooks: For customers that have technical resources, Webhooks can be utilized to completely automate transaction status updates. Many businesses have a goal of reducing the cost of receivable payment acceptance. Providing a Bill Presentment and Payment solution is a good step in doing so. This solution can be implemented with absolutely no development programming. It just makes sense to provide as many technology channels as possible for merchant customers to locate and pay their invoices with zero involvement from the merchant organization’s customer service team. Moreover, customers get irritated if they call and have to wait for a customer service representative in order to make a payment. Happier customers lead to better retention. In terms of security, the BillFind+Pay solution resides on a PCI level 1 certified platform. And let’s not forget the inherent risks with live customer service agents taking sensitive credit card or checking account data over the phone. Potential disgruntled employees are removed from the risk factor in handling credit card are ACH payments data. All companies seek to satisfy their customers. Technology has brought great abilities to present billing statements and methods to accept the associated payments. There are few companies who have yet to embrace these new payment acceptance technologies that have recently come about. Let’s get your organization on-board with some new tech – a Bill Presentment and Payment solution. Contact us to discuss what Agile Payments can do for your organization for Bill Presentment and Invoice lookup. Agile Payments has been supplying organizations with payments related tools for 18+ years. As a bill presentment provider we can help your business become more efficient and profitable.