What can be done?

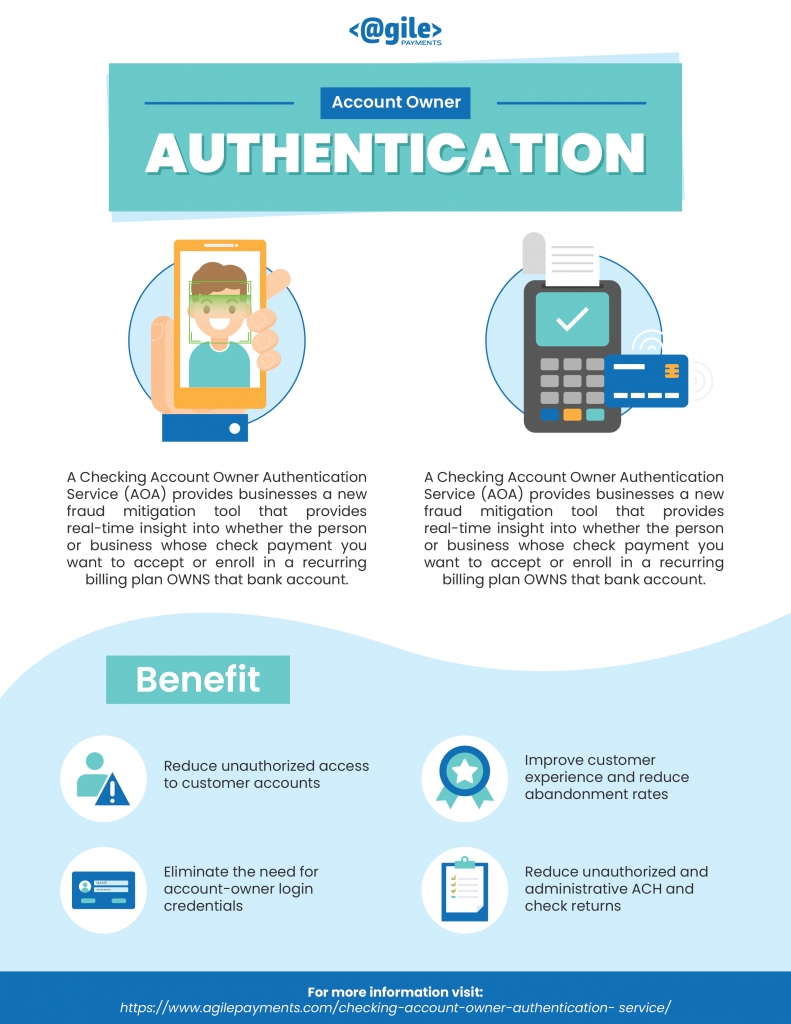

Recent tech advances have now made a Checking Account Owner Authentication Service available. Real-time checking account verification and account owner authentication services can confirm a consumer or business owns the account and is authorized to transact.