Integrating a Credit Card Payment Processing solution offers your application users the ability to pay for goods or services via debit and credit cards. If your product or SAAS offers any kind of recurring payment functionality then a Credit Card Transaction Integration needs to be part of your offering.

We have been meeting the payment gateways needs of apps and stand-alone software for over 15 years. Credit Card Payment Integration has been a core offering and we are experts. Our specialty is partnering with software or SAAS providers and creating payment solutions that make collecting customer payments simple and efficient. At the same time, your platform can generate a new revenue stream without added support burdens. Our specialty and deep experience lie in recurring payment solutions with both collection (disbursement as well) and reconciliation needs.

Credit card integrations typically start with one of two primary types of software platforms:

In either case the using organizations are providing a service or delivering products to end-users or customers. Since transactions via a software application are generally performed in a MOTO (card not present) environment, accepting cash simply doesn’t work. Therein lies the need to accept credit cards, and with technological advances over the past 10 or so years, payments providers have developed robust payment integration API’s that are capable of enabling integrating organization’s with complete functionality in order to originate, manage, reconcile and deliver notifications from within the organization’s software application.

The integrating organization’s software becomes a payments platform in itself

You may also consider an ACH Integration. Here is why:

Some notes on the sensitive data surrounding credit cards:

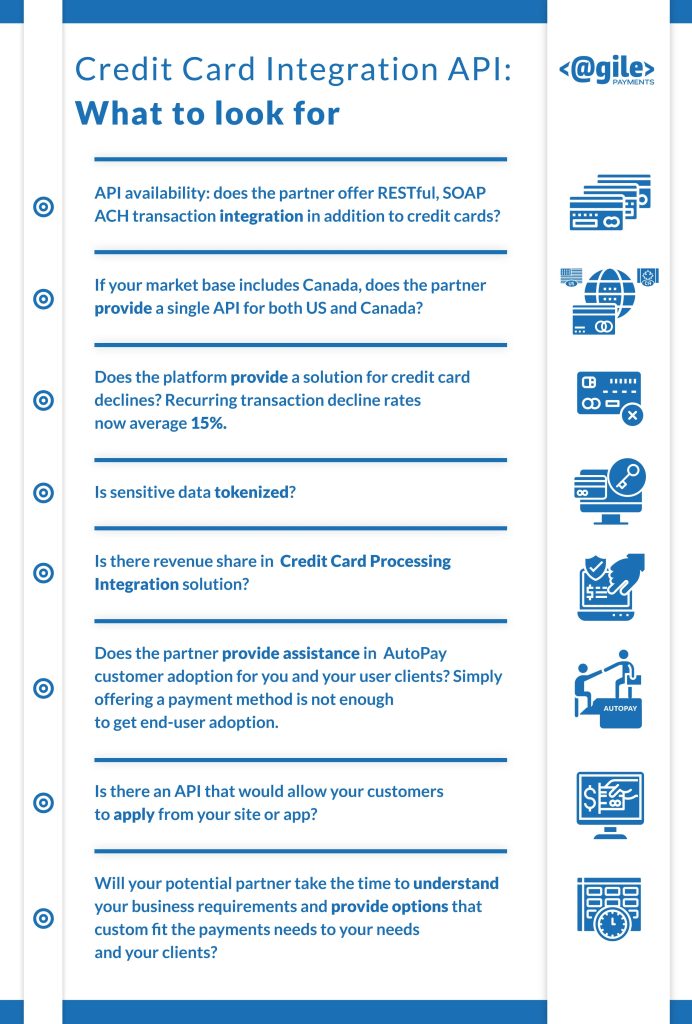

Most all credit card processing integration providers replace the actual card data with reference tokens these days in order to mitigate the risk of data theft. If there are some that don’t, run away from those providers. What needs to be examined here prior to the credit card API integration is how can the actual card data be acquired by the merchant of record in the case that they decide to migrate to a different merchant service provider? What you don’t want to find yourself in is a place where the credit card service provider is holding that card data hostage. Data hostaging can come in two forms:

Decline management:

In the card not present SaaS credit card transaction space, credit card declines are a huge problem. Declines average 15%. These declines can cause all sorts of problems, from having customer service reps chasing down new card data to lost revenue. Any organization using a software application being in a subscription based model or having recurring transactions need to have a systematic approach in dealing with credit card declines, and the best way to manage that is through the integrating API itself.

A good credit card integration API will have connectivity to the card network’s updater programs. Card networks are always busy re-issuing credit cards, whether it be from compromised cards, expirations or simply being lost. The card networks keep track of these re-issues and make update files available on a monthly basis. These updates are an additional expense on top of the normal processing fees, but the amounts are miniscule when compared to manually chasing down new card data. Moreover, you’re only charged if there is an update.

In addition to credit card updater files, an organization can programmatically employ credit card retry logic. We at Agile Payments are here to assist your organization in that respect.

Revenue for vertical SaaS organizations:

It’s no secret any longer that software platform who have multiple businesses or organizations using their software are receiving revenue from their credit card API integration. Agile Payments has been at the forefront of revenue share agreements for over 15 years. Why? Because an integrated platform becomes a defacto sales agent for the processing provider. They should be rewarded with revenue for their integration and the vertical reach they have to their user base. It starts with a conversation about the application and who it will serve. From there we will present options and arrive at a model that works best for everyone involved. Have you considered the best revenue share situation for your credit card API integration?

That’s just a start at some of the common questions you might ask. With Agile Payments, we take the time to learn your business requirements and needs first. We have ACH app clients in sectors that span a wide spectrum. In every case we have become a valuable and trusted partner to these providers–to the point where we help in other business areas [eg client acquisition strategies].

Creating an Credit Card payment integration solution leads to more satisfied clients. It can provide a more economical method for streamlining cash flow, and if there are recurring payments requirements as part of your app or market you serve, we are the experts. Predictable, less expensive payment vehicle and API functionality that will empower your software and add value for your user base.

Combined with our revenue share model for integrated partners you can drive significant bottom line growth to your business.

CCPI enable organizatiosn to automate the collection and reconciliation of credit card payments. There may fraud tools and retry logic for failed payments as well as a card updater option that makes tracking down failed payment info much less labor intensive

Advanced anti-fraud measures, refund capabilities, retyur capabilities, an updater program, redundancy and timely support. A reporting portal should also be available for end-user self-service.

There should be no cost to integrate. Typically you will be charge a per transaction gateway fee and a nominal monthly. These fees are in addition to card Interchange fees and processor markups