A Payment Facilitator or PayFac assumes the role of Master Merchant. Payment Facilitating allows the Master Merchant to quickly and easily onboard their sub merchants or in the case of a SaaS platform Payment Facilitating allows platform users to the ability to accept credit, debit card and in some case ACH transactions for participants in their payment ecosystem.

The Payment Facilitator is responsible for regulatory compliance and has financial risk of their sub-users though in a Managed Payment Payment Facilitating role the SaaS platform will have no risk and limited compliance.

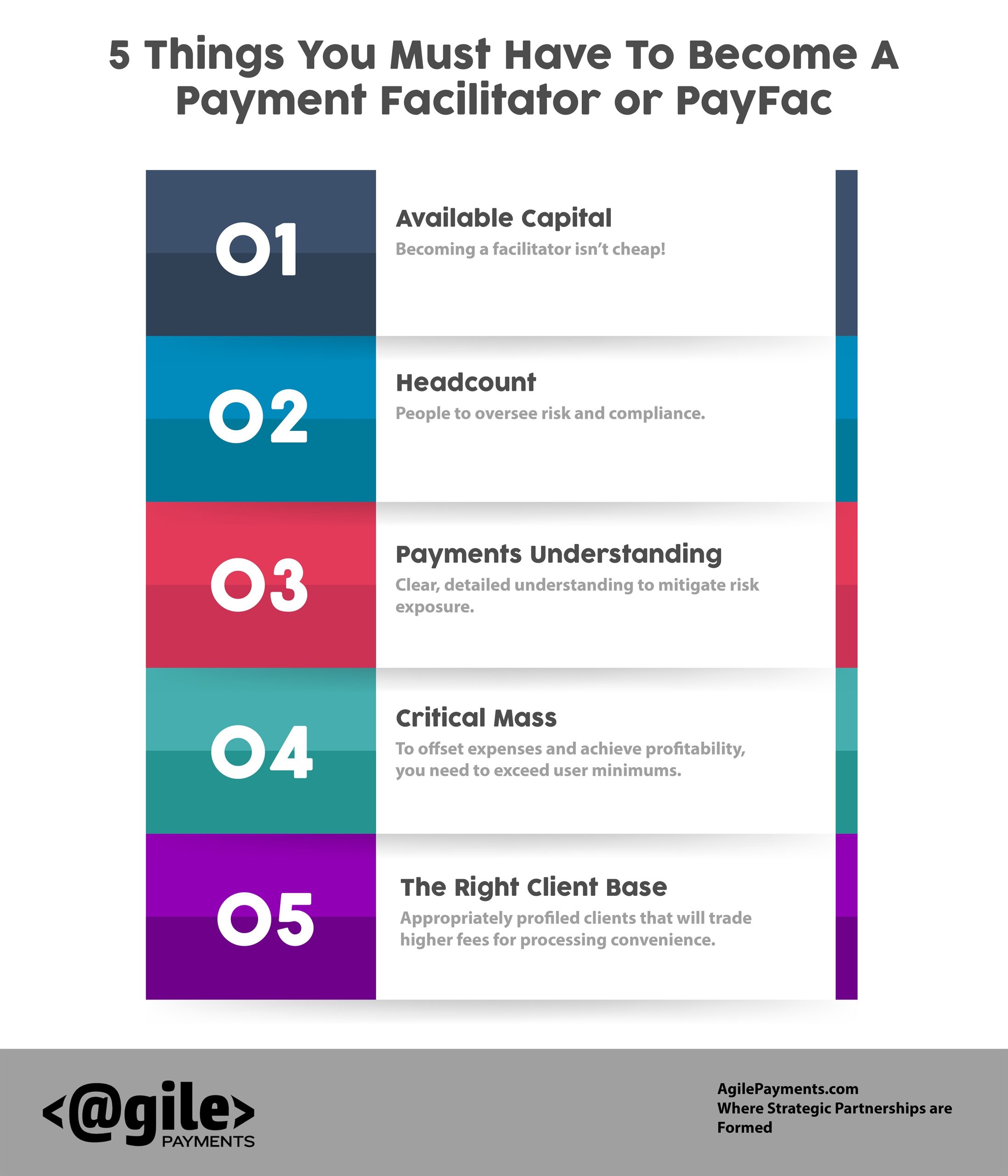

In the past the only Payment Facilitating option Provider was to become a “True PayFac”. This undertaking is expensive, time consuming and requires staffing to meet compliance and risk mitigation demands. In essence you become a payment business in addition to to your core SaaS offering. See below for must haves:

Today technology and regulation changes enable a Hybrid or Managed Payment Facilitation model. In this scenario the SaaS platform looking to gain the benefits of being a Payment Facilitator [fast onboarding, revenue generation, more control of payments process] can take advantage of the PayFac benefits without incurring much of the costs or significant compliance challenges.

In both True and Managed Payment Facilitator models there is a revenue stream generated for every payment transaction. Typically the True Payment Facilitator model offers greater revenue potential but is often not the case. Much depends on the SaaS offering and a-perceived risk b-overall payments volume.

If your app has a low risk high potential $ processing volume you tend to have negotiating power and the revenue generation potential tends to be about equal.

Becoming a Payment Facilitator or PSP [Payment Service Provider] is often a great fit for SaaS platforms that offer a payment processing solution.

But where do you find a Payment Facilitating Provider?

{{cta(‘601e70d1-425a-4bc8-a2bb-9e417399adce’,’justifycenter’)}}

Initially Vantiv was the only choice and required that you become a true Payment Facilitator. As technology and regulations have evolved the Managed Payment Facilitator option has become available. There are now several acquiring banks that offer the ability to to leverage PayFac like capabilities without the massive time and $ investments. These include TSYS | Wells Fargo and PaySafe.

In summary your search for a Payment Facilitating Partner should start with a conversation.Our strength is creating partnerships that help your business be more profitable.

That’s a question best answered by having a conversation with you guessed it: Agile Payments. Our strength is creating partnerships that help your business be more profitable.