Pay by Text payment solutions offer businesses a simple, cost effective method to securely collect customer payments.

The vast majority of consumers have their phone in within reach the majority of each day. Being able to leverage text messages to automatically collect late payments [or regular payments] offers benefits to both businesses and their customers.

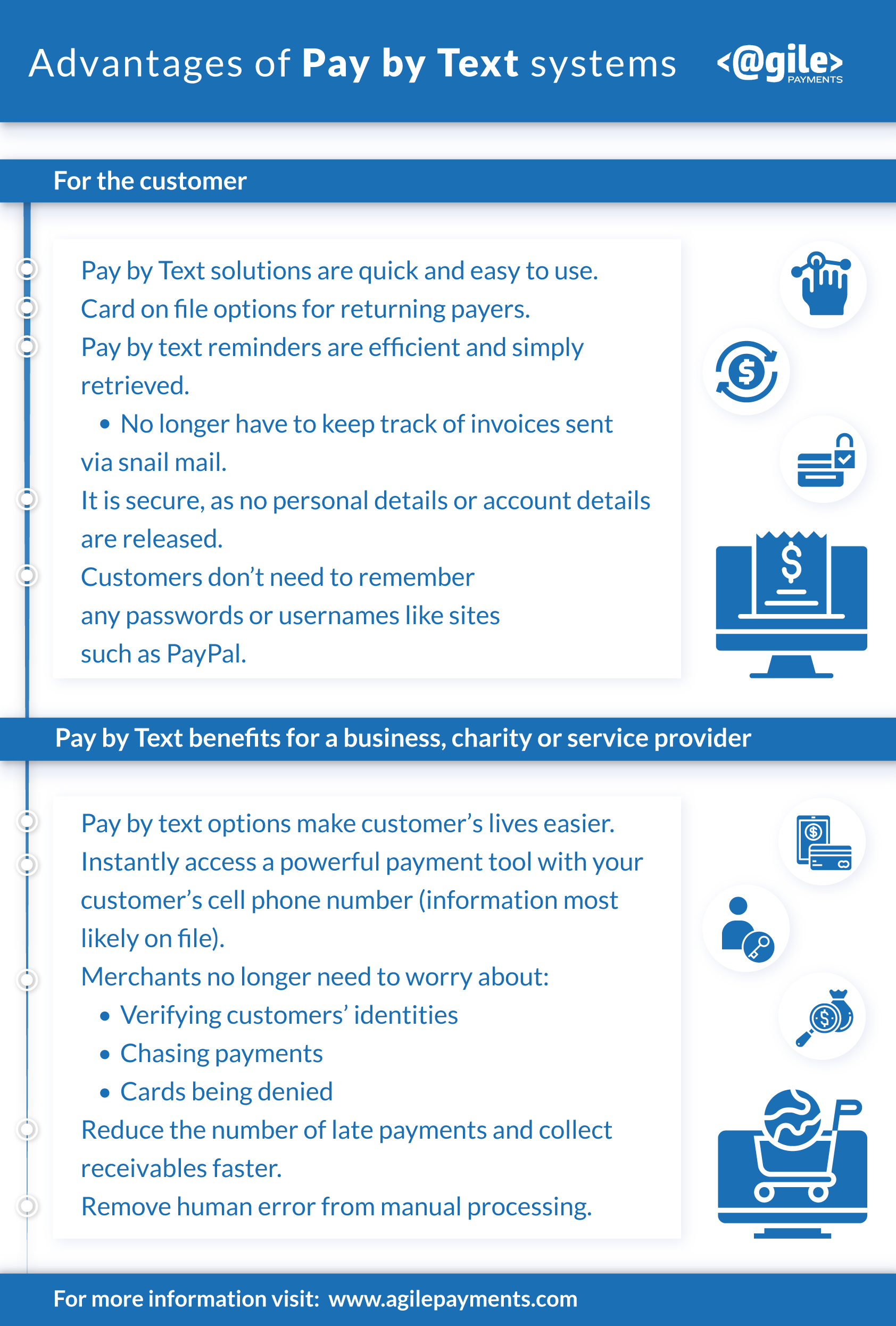

Advantages of Pay by text payment systems

For the customer

- Pay by text Payments are quick and easy to use.

- After the initial setup, there is no need to have a payment method on hand – it is already saved in our secure environment.

- Text pay reminders are efficient and simply retrieved.

- No longer have to keep track of invoices sent via snail mail.

- It is secure, as no personal details or account details are released.

- Similarly, Customers will no longer be divulging sensitive information over the phone.

- The purchaser doesn’t have to enter their credit card or bank details, or even have a bank account.

- Customers don’t need to remember any passwords or usernames like sites such as PayPal.

For the business, charity or service provider

- The merchant can accept payments from any of the billions of mobile phones capable of texting worldwide.

- Easy to use

- Improved customer satisfaction.

- Instantly access a powerful payment tool with your customer’s cell phone number (information most likely on file).

- Merchants can receive payments from customers without a bank account or credit card.

- Customers that would have otherwise not been reached.

- Can build upon customer loyalty through:

- Pay by text marketing messages

- Discounts

- Coupons

- Merchants no longer need to worry about:

- Verifying customers’ identities

- Chasing payments

- Cards being denied

- Reduce the number of late payments and collect receivables faster.

- Remove human error from manual processing.

- Avoid data input mistakes (e.g. card and checking account numbers)

- Motivate more customers to go paperless.

Pay by text Payment Plan Case Study

An auto insurance company implemented an outbound Pay by text payment collection program.

When the premium payment due was 2 days day late a text was sent to the customer advising the payment was due as well as the importance of continued coverage.

A second outbound text to pay was sent when payment was 2 more days late.

The insurance company simply securely uploaded a csv file from their billing system containing relevant policy and customer information. The text contained instructions on how to make payment.

If the customer had already opted into the text to pay solution they could simply use the securely stored payment method. If a new user they were walked through the payment set up.

As part of the Pay by text payment solution, a settlement file with relevant details is made available to the insurance company, allowing them to reconcile payments in an automated fashion.

A significant decrease in live collection calls were realized as well as a drop in policy cancellations.

Both of the above resulted in reduced labor costs as well as the costs involved in policy cancellations.

The improvements in operational efficiency result in higher profit margins. Better collection rates improved cash flow.

For more information on using Pay by Text Solutions in your business visit:

https://www.agilepayments.com/Pay by text-payment-provider-solutions/