Here at Agile Payments, we have been working with credit unions for a long time. Some for partnerships in enabling their client base with merchant processing solutions or solutions like direct deposit payroll for internal use. Not too long ago a credit union client came to us with some specific needs; mainly reducing the amount of time that their customer service reps spend in taking payments over the phone and replacing what was a difficult to use website payment system.

For reducing the time spent by customer service reps taking information over the phone for the credit union loan payments, they wanted something automated. Interactive Voice Response Payments (IVR Payments) was proposed. The solution implemented completely eliminated the time spent by the customer service reps. A toll free number was supplied that enabled the credit union to program their phone system to transfer over those calling to remit loans payments to the IVR supplied phone number.

The IVR payment system has the capability to handle both credit card and ACH processing (eCheck) transactions. Many times in a loan payment senario, the lender doesn’t want to incur what is the additional transactional costs of allowing loans to be paid by credit cards. This particular credit union wanted to offer the flexibility to it’s members of paying with a credit card. However, with the choice of option the payor would incur a service fee to complete the transaction. When paying by eCheck, the consumer also incurs a service fee, albeit at what typically amounts to a much lower fee. Therefore, the choice of payment method is left completely up to the consumer who is making a loan payment; choose a credit card for reward points as an example, but pay a higher service fee than if paying via eCheck.

This solution, once the initial setup fee has been covered, allows the credit union to have all of their payments processed with no monthly or per transaction fees incurred to their merchant account.

The IVR payment system is updated by csv file upload and there are varying options that can be employed such as forcing a customer’s oldest outstanding invoice to be paid first. Dedicated toll free numbers are also an option if the credit union’s phone system isn’t capable of transferring over to a shared toll free number. In either case, custom scripts are presented to the callers.

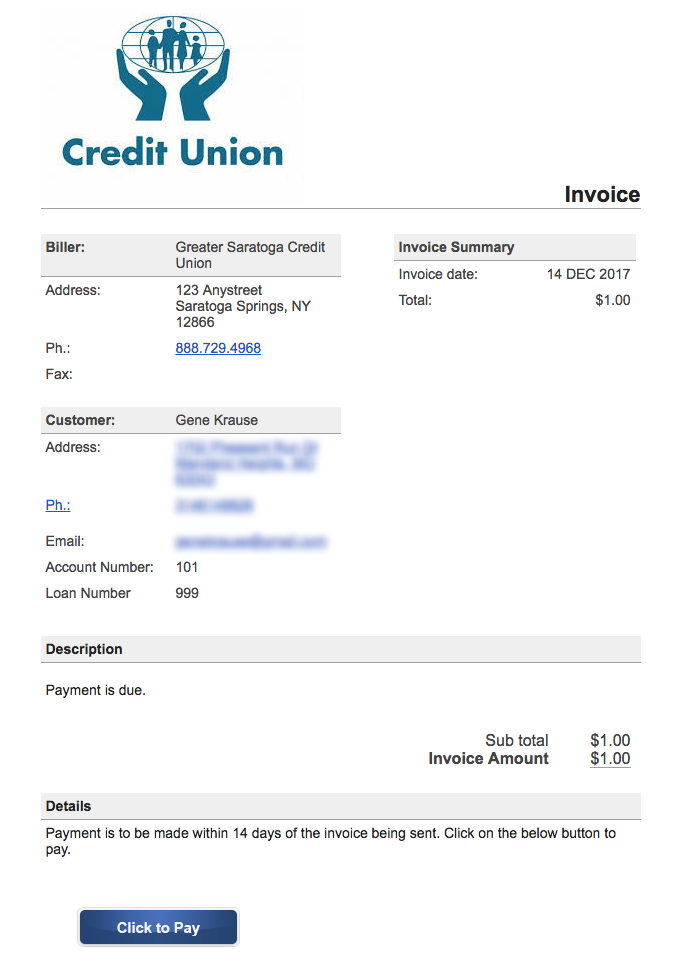

The IVR system was easy to propose and implement because it’s been in use for a number of years, mainly serving  government entities at the state and local level. That left the website solution. The credit union client wanted something that a customer could go to their website and search for their invoice and subsequently remit payment. While we had an existing system that could be used and that the loan invoices data is fundamentally managed like the IVR system, this client wanted to present an invoice on their actual website.

government entities at the state and local level. That left the website solution. The credit union client wanted something that a customer could go to their website and search for their invoice and subsequently remit payment. While we had an existing system that could be used and that the loan invoices data is fundamentally managed like the IVR system, this client wanted to present an invoice on their actual website.

The credit union’s website is built on the CMS WordPress.org platform. What we developed was a bill lookup and presentment plugin for wordpress CMS that does a number of things:

- Provides the ability to search and find a loan invoice to be paid.

- Provides a template that the CU can customize for email invoice delivery.

- Provides merchant definable fields to make data relevant to the using organization.

- Provides the ability for recurring invoices.

- Provides the ability to upload bulk invoices via csv import.

- Provides the ability for the CU to determine what fields are searchable when a customer is trying to locate an invoice.

Most importantly, the payment page that is presented to the consumer is a javascript modal that is presented on top of the credit union’s website that transmits directly to the gateway server.s In other words, no sensitive data ever touches the CU’s website server. Therefore, there is no risk of data theft from infiltration of the credit union’s web server’s database. Instead of the CU storing sensitive data, they are returned a reference token that can be used for future transaction calls.

Reporting is also delivered straight to the wordpress plugin settings via webhooks – a near real time method of obtaining transactional data. Using the accompanying Virtual Terminal, the client can view download all settlement and funding data, as well as perform any necessary refunds.

If you are part of a credit union and would like to learn more about the IVR Payments or Bill Lookup and Presentment solution, give us a shout.