Instant Payouts: A Guide for Saas Platforms

The world is changing, folks. Gone are the times when people would accept payments taking days to reach their accounts for work they’ve completed. Nowadays, when a freelancer or employee completes their job, they want to know that they’ve been paid immediately.

And if you’re a Marketplace provider or SaaS platform, you’ll know that that responsibility falls on you. This is why Instant Payouts are the way forward. Businesses that become Instant Payout Providers equip themselves to compete in a saturated market, retain employees, and build faith in their business. Want to know why? Read on.

Why Are Instant Payouts Good For My Business?

Money talks, and the quicker you pay people, the more they want to come back. Saas Platforms that are Instant Payout Providers understand this better than anyone. In a world where freelancers are free to hop from employer to employer, having an Instant Payout system signposts that your business cares about getting its workers paid on time.

This, naturally, leads to better employee retention – which, in turn, helps your business grow. This also generally means that employees will be more loyal to your business and service, recommending others, which has a snowball effect.

But that’s not all. Depending on the type of Instant Payouts that are operated, Instant Payout Providers can benefit from transaction fees, creating a brand-new revenue stream for their business. Even if the fee is just 1%, over time, that can make up a huge amount.

What Payout Options Do I Have?

The best news for Instant Payout Providers is that they’re not limited in their options for paying workers. This means that your employees can be paid in the manner they wish, again leading to better retention rates.

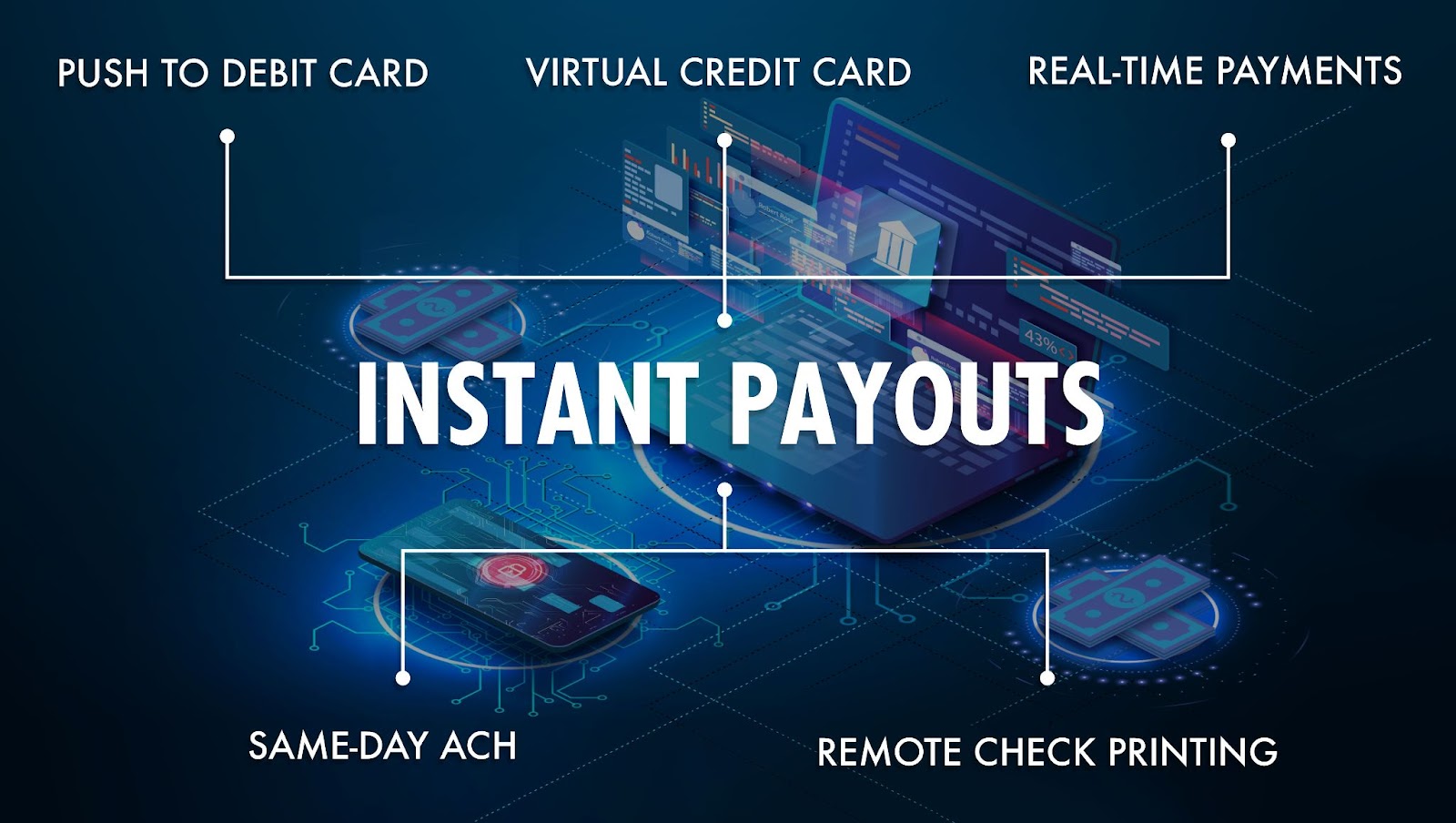

Using push to debit card, businesses can get their employees their money ASAP. Offering this option also creates a revenue stream for the business via transaction fees.

Same-day ACH payments and real-time payments (RTP) are both options when it comes to Instant Payouts. It’s important to note that can be a lag in access and payment times (on the RTP side, depending on geographical location, and the ACH side, depending on the time of day the payment is sent), but familiarising yourself with the logistics can help.

Remote check printing and virtual credit cards are also modes of payment that Instant Payout Providers can deliver, and which employees may prefer. Whatever they desire, you can get it done.

What Are The Risks?

The main risk that Instant Payout Providers face is around the exiting of funds, which may result in some businesses being caught short. A pre-funded account, similar to an escrow account, can mitigate this risk, ensuring that funds are always available.

The Bottom Line

Your employees need to be paid fast – and Instant Payout Providers understand this, and have seen the benefits from doing so. Instant Payouts are the future of payments, and this lightning-fast payment method is quickly becoming the norm. Don’t be left behind.

To discuss installing Instant Payouts for your platform, contact Agile Payments today. Our team of personable experts will get you up to speed with everything you need. Get in touch now.