Checking Account Verification Companies offer tools that enable businesses to verify a checking account is open and in good standing. This service can typically be run in real-time or batch mode.

Businesses that enroll or onboard a new customer in a recurring or subscription based billing environment need to be able to confirm checking account data is accurate and that the customer has a bank account that is both open and in good standing. Checking Account Verification eliminates considerable admin burdens that arise onboarding a new client with non billable data.

Service levels differ with some Checking Account Verification Companies offering basic routing # validation ( bank routing number) to negative database checks. These provide some level of risk mitigation but more insight is available including the ability in real-time to validate the account is open and in good standing. It is important to note a balance inquiry is only possible when the consumer provides credentials that allow access to their specific online banking system.

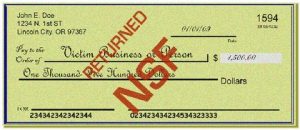

The ECheck or electronic check world does not have the authorization component present with credit cards. When processing a credit card you are able to ascertain at the time of payment that the customer has the requisite funds on their card and in turn reserve those funds for capture and settlement. In essence-You know you are getting paid.

For many businesses no authorization component means that a a ECheck Verification system is needed to mitigate payment acceptance risk. Companies must also Validate a Checking Account as of 2021.

Contrast the credit card authorization component with ECheck processing: An ECheck transaction processed today goes to the ACH network for debiting the customer tomorrow morning [assuming tomorrow is a banking day]. There are two banks involved: The bank initiating the debit on behalf of their merchant [ODFI] and the customer’s bank [RDFI].

Those two bank have another day to sort out any reasons for rejecting the debit eg NSF, closed account etc.

New customer intake can be a major friction point for any business that relies on future recurring payments. Examples would be insurance companies with premium payments, an alarm monitoring business collecting monthly monitoring fees or car loan repayment.

The customer may provide their bank account and routing info or a voided check might be taken. In either case there is the potential for user error when inputting data.

Checking Account Verification Companies

The business has multiple issues to address: The insurance company has to void the policy and may have exposure from an accident. That customer must be contacted for payment. Accounting may need to be undone.

Mitigating loss through third party check verification systems can be an important part of the business that relies on ACH processing for echeck acceptance.

So what are your options?

Most third party checking account verification services include the most basic tool of routing account number validation. The bank routing number identifies the bank the check is drawn against. The databases holding this information can be checked in real time.

The next level is negative databases. Based on history [both positive/negative] of that checking account info, a response is returned regarding the account status. An example would be writing a check at Home Depot. If the check is good or bad, WalMart can report that check status to the database. With many retailers contributing data to the network there are many millions of checking accounts to reference.

Recency is an issue, as the customer’s last instance of writing a check at a participating retailer becomes the last data point. This means that data can be stale or a known bad check writer may not have made it into the database in a timely fashion.

The next level is Real-time Check verification and Validation comes from banks and Credit Unions contributing data from their ATM network. A daily upload of account status is made to the network and queries to the network can provide account insight. When a check verification inquiry comes in a real-time response can be generated. These responses can tell you:

- account is closed

- account # is invalid

- account is non DDA eg Home Equity checks

- account is in an NSF status: For some businesses this is important as they do they know they have a good account

- account has pending NSF’s or stop payments

- account is open and in good standing with a positive funds balance.Importantly you do not get a balance confirmation. The account can have $2 or $25000.

**Note: There are services that can check balances. However in order to leverage these systems the customer must either log-in to their online banking or provide their credentials for logging in. This can create friction in an online setting and phone payments would not be eligible.

To learn more about Check Verification Companies [ including back testing your data ] contact AgilePayments today