Authenticating ownership of a bank account is a crucial step in ensuring the security and integrity of financial transactions. It is a process of verifying that the person claiming to own a bank account is indeed the rightful owner. This can be done through a variety of means, including providing personal identification, answering security questions, or providing a signature.

NACHA mandates that WEB ACH transactions are validated. Authenticating Ownership of a Bank account goes far beyond validation.

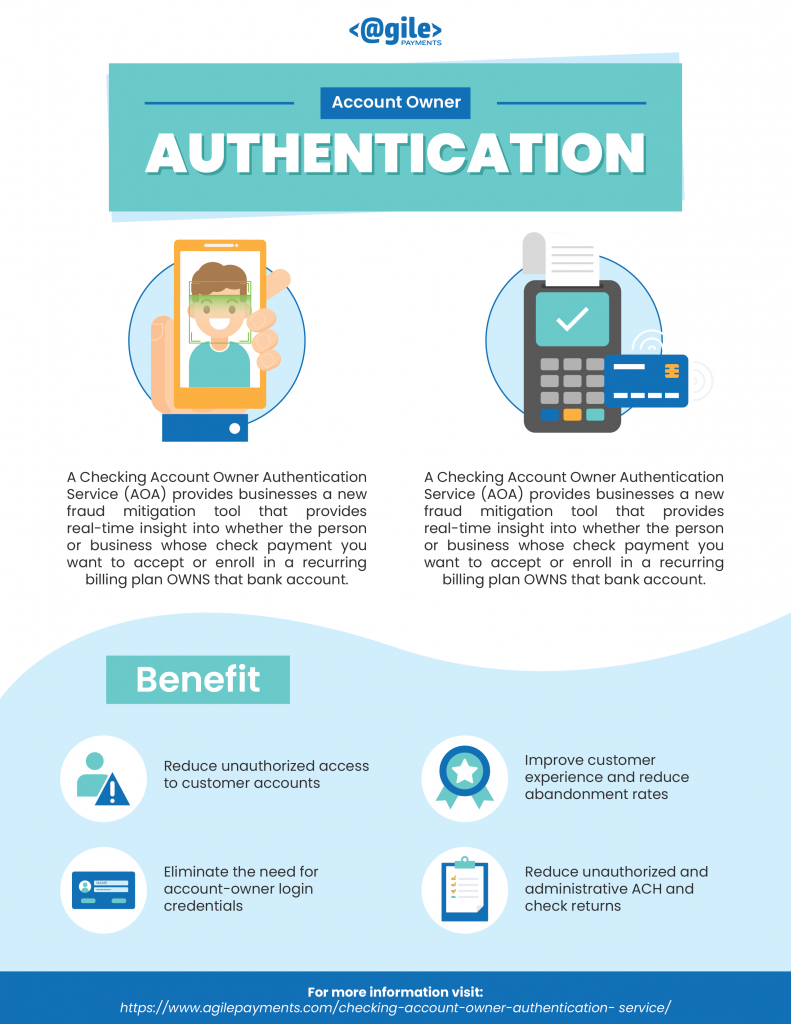

However, there’s another way to authenticate ownership of bank accounts – and it’s automated and it’s frictionless, meaning there’s no bank login required. It’s called Account Ownership Authentication, and it can be accessed via a web based portal or it can be integrated via an API.

There are many advantages to authenticating ownership of a bank account, including:

-

Fraud prevention: By verifying the identity of the account holder, banks and ACH processors can prevent fraudulent transactions from occurring. This is especially important when conducting online transactions, as it can be difficult to verify the identity of the person on the other end of the transaction.

-

Increased security: Authenticating ownership of a bank account helps to secure the account from unauthorized access. This is especially important for accounts with large balances or those that are used for sensitive financial transactions.

-

Improved customer service: By authenticating the ownership of a bank account, banks and processors can provide better customer service. For example, if a customer forgets their password or security questions, they can be quickly and easily verified as the account holder and have their account information reset.

-

Increased trust: By authenticating the ownership of a bank account, banks and processors can increase trust in their customers. This is especially important for businesses that rely on online transactions, as customers are more likely to do business with a company they trust.

-

Compliance with regulations: Many financial regulations require banks to verify the identity of their customers. By authenticating ownership of a bank account, processors can ensure that they are in compliance with these regulations and avoid penalties.

In conclusion, authenticating ownership of a bank account is a crucial step in ensuring the security and integrity of financial transactions. It helps to prevent fraud, increase security, improve customer service, increase trust, and comply with regulations. By taking the necessary steps to authenticate the ownership of a bank account, banks and their customers can rest assured that their financial transactions are safe and secure.