Lifetime Customer Value

For companies that bill their customers on a monthly basis there is one metric that guides all of your marketing/sales efforts. Knowing Lifetime Customer Value [LCV] is like having a Secret Weapon in your battle for customer acquisition.

Customer acquisition costs have skyrocketed. Competition for new clients is fierce and expensive. Although there are new marketing channels like Adwords, Facebook and Twitter ads, retargeting etc these channels can be intimidating and certainly punish those financially who don’t use them in optimized ways.

Cost per click for high competition Adwords keywords can be over $50 per click-and that just gets them to your website. If you convert 5% to paying customers you are spending $1000 to acquire a single customer. So why are there companies spending $100’s of thousands of dollars per month doing just this?

Because they know the Most Valuable Metric: Lifetime Customer Value. If they know a new Insurance customer is on average worth $3000 in profit you can see why they are willing to spend so much to acquire them. Unfortunately most businesses have not thought about LCV and more importantly how vital it is to guiding your marketing and sales strategy.

So how do you calculate LCV? There are multiple ways-here is Wikipedia convoluted suggestion:

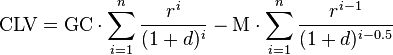

Thus, one of the ways to calculate CLV, where period is a year, is as follows:[7]

where

We are in the recurring billing space and depend on monthly revenue per client. For businesses that bill regularly eg gyms, insurance, alarm etc here is how we like to measure [little more simple]:

Monthly revenue X Average customer life [months] X Retention rate X Profit margin X Referral Factor X Upsell/Frequency factor

So as an example let’s say we have a client paying $40/month in revenue and that average customer life is 4 years. Retention rate is 90% and our profit margin is 35%.

Your customer base is your most valuable asset and you should definitely have a structured referral program in place to leverage more clients-John Jantsch over at www.DuctTapeMarketing.com has tons of great resources/books on referral generation and more. We will use 5% as our estimate to what percentage of our base refers a new client. This creates referral factor of 1.05.

Upsell/Frequency factor is an estimate for additional revenue from that client. This could come from moving them to a higher priced plan or selling additional services or their buying more frequently. We will estimate a 10% bump for a 1.1 X factor.

Here is a simple tool to calculate your LCV : https://www.agilepayments.com/lcv

For this example our LCV = $700 based on $40×48 months x 90% retention rate x 35% profit x 1.05 referral factor x 1.1 upsell/frequency factor

So this customer is worth $700 in net profit. That makes spending less than that to acquire them profitable. But there are more considerations: One is that many businesses are valued by their monthly revenue. Let’s say this business would sell at a 24X multiple of monthly profits. Every new client you bring on adds close to $17,000 to your business valuation. If an exit strategy or partial sale of you business is on the horizon new customers are hugely valuable.

Another consideration is that every new customer either gets you closer to “critical mass”. This is the point at which it becomes easier to gain customers and you are becoming a known quantity. Not every second of your day is spent worried you don’t have enough clients to make your business work.

In certain cases it even makes sense to acquire customers at a loss. Many start ups and even established businesses are confident that as their business grows they will be able to cut expenses [economies of scale] and drive enough incremental revenue so they will be able to create a profitable revenue stream. Most businesses can’t afford this tactic for any prolonged time period.

So get calculating so you know your LCV and can think strategically about planning your customer acquisition plans.

How do you calculate customer value and can you share any insights?