The SaaS (Software-as-a-Service) companies/startups have popped up all around the world. They are bringing value to people’s lives simply through the product and that has become a true hallmark of modern times.

In the modern SaaS industry, the payment process can encounter many challenges. This article will present some of the most significant payment obstacles and how to overcome them so that you can be one step ahead if you emerge in this industry.

What is SaaS?

Before we continue, let’s clarify what exactly is SaaS so that there wouldn’t be any confusion along the way.

Software as a service (SaaS) is a method of software delivery that allows data to be accessed from any device with an Internet connection and a web browser. In this web-based model, software vendors host and maintain the servers, databases, and code that constitute an application.

SaaS is one of three main categories of cloud computing, along with infrastructure as a service (IaaS) and platform as a service (PaaS)

According to Cisco’s Global Cloud Index for the period 2013-2018, 59% of all cloud workflows will be delivered as software-as-a-service (SaaS) by the end of this year.

Just think of any service you use in your day-to-day life, whether it is Netflix, Spotify, Quickbooks Online, Google Drive, etc. They are all a part of the SaaS industry.

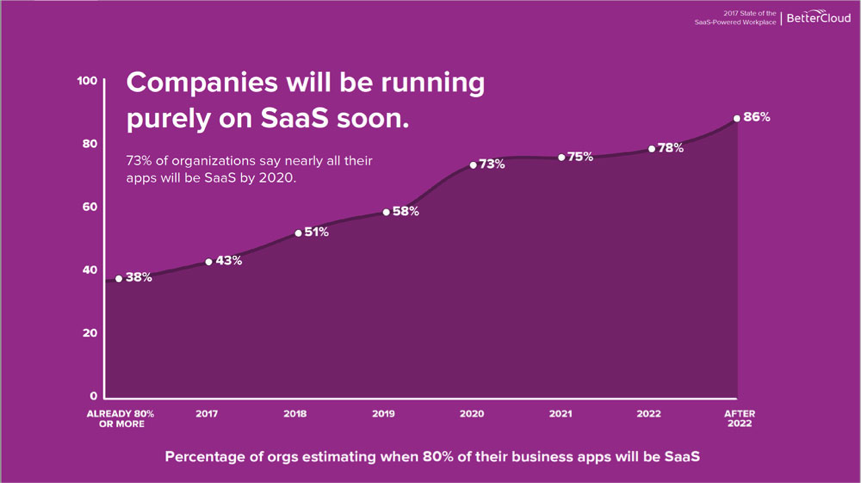

Better Cloud also presented the continuous growth of the SaaS industry and their predictions for the future on the following chart.

Source: Better Cloud

You may ask what has driven such popularity to SaaS?

One of the reasons is that company’s operations no longer depend on legacy systems since more than 80% of their performance is being hosted and maneuvered in a cloud.

In addition, SaaS benefits often come down to serious financial savings.

The affordable price of SaaS technology enables expansion of the corporate ecosystem with a number of new apps. It also involves everyone on board in how those apps are managed and operated. The main beneficiaries are small and medium businesses.

1. Obstacles in the User Experience Sector

Users have different expectations of the product they are using, not to mention when it comes to giving their money away.

Those who want to smooth the transition from free users to paid customers need to be very careful with the payment process.

Customers’ experience and reviews can further define the success of the business. Not being able to provide the customers with the most common paying methods as a part of your service can lead to vas dissatisfaction.

The solution is to implement payment options that offer a simple and positive customer experience across all devices, as well as to cater to varying local payment methods.

You need to find the best way to accommodate customers’ payment requirements and preferences. To achieve this, you can poll the customer base and discover the preferred payment methods.

Customer experience improvements are closely tied to key SaaS metrics like conversion, churn and lifetime value (LTV) so focusing on building an easy to use, the customer-centric payment process is definitely a step in the right direction.

2. Obstacles in the Encryption and Secure Payments

The emerging security regulations demand extra care for processing customer payments. This need becomes even more excessive as the number of customers increases.

You need to be able to handle a growing number of payments and to keep the financial part of your business secure in order to protect both your company and your customers.

That is why it is crucial to find and implement a payment processing solution that offers RSA encryption, has the ability to store customer payment data safely, and has approval from local European regulators.

Focus on options which will simplify this process by removing some of the intricacies of processing sensitive customer information.

3. Obstacles in the Integration

Another aspect of SaaS which causes major challenges for businesses is integrations. The payments are no exceptions.

“If a payment processing resource has ready-to-go integrations, that’s great for the business. In case it doesn’t, you will need to spend weeks coding it,” explains software support specialist at PickWriters. He adds, “It is best if you opt for a payment processing tool that can grow with your organization.”

You need to focus on flexibility when you are selecting a payment processing tool. Try to find a solution with an open API so you can develop the necessary integrations for your SaaS business.

If you have open opportunities for integration that will lead to more automation and simpler, more efficient processes across the board. This will also give you a more complete understanding of the customer.

4. Failed Payments Management

Failed transactions have an immense impact on growing SaaS companies because it leads to lost revenue.

Failed credit card payments can hurt your SaaS business in two ways:

1. The problem of churn – Because of the subscription revenue, a failed transaction can mean losing a long-term customer. Months or even years of revenue can be lost through a simple glitch or a customer’s forgetfulness. Credit card-based churn is something most companies have experienced.

2. Human resource and time drain – It takes time to follow through on your failed payments which means that it will cost your SaaS team and your shareholders/backers reinvested revenue that could otherwise go to paychecks and profits.

Your solution lies in an automated way to handle failed credit card payments. By applying that, it will prevent the churn these failed payments can create without taking up inordinate resources.

You’ll be able to keep your revenue fee for better uses.

Conclusion

The SaaS industry is seen as a future inevitability of the business world. Considering its growing power, it can be crucial if you prepare yourself and your business for possible upcoming challenges in this industry.

Don’t focus on the problem, but focus on the solution and how to overcome the obstacle and at the same time not cause damage to your company or your customers. That is, look for solutions that empower you to reach the goal, have robust support, deliver strong customer experiences, and that can grow alongside your businesses.