The payment collection module is a part [ a very important one] of the SaaS platform offering. Prospective customers sign up for the platform and as part of that they provide business info and their bank account data.

In the past the HVAC operator would complete a fairly burdensome merchant account application, wait up to week or more to be approved, and then somehow enter their credentials into the SaaS application.

Traditional Payment Facilitation Solutions involved the platform going through an arduous application process. Think a home mortgage for 10 million $ and then double the hassle.

That process served to mitigate financial risk as the platform operating as the PayFac is funded the money from sub-merchant processing. If there were instances of fraud or wrongdoing the PayFac platform provider was on the hook for financial loss.

Integrating the payment onboarding, processing solution, risk, payout etc typically was a 6-month process. You can easily spend $250k to get started.

In some cases, depending on the flow you might also have Money Service Business or Money Transmitter licensing obligations.

Add ongoing risk mitigation and compliance costs and it is very easy to see why true Payment Facilitation is only for the big players.

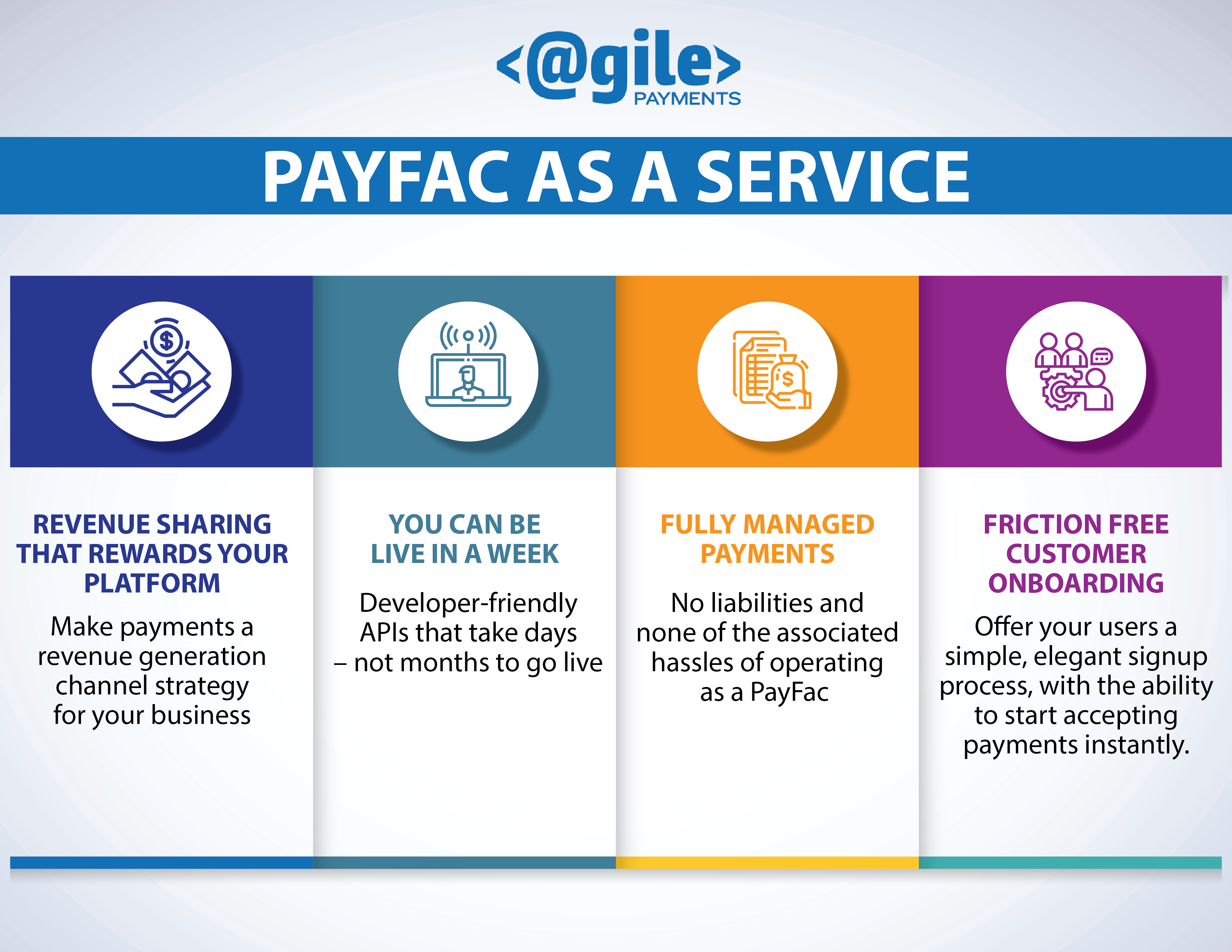

In the last few years, payment providers have realized there’s a sizeable market for Payment Facilitator like solutions without all of the expense and hassle.

Enter PayFac as a Service or Payment Facilitation As A Service

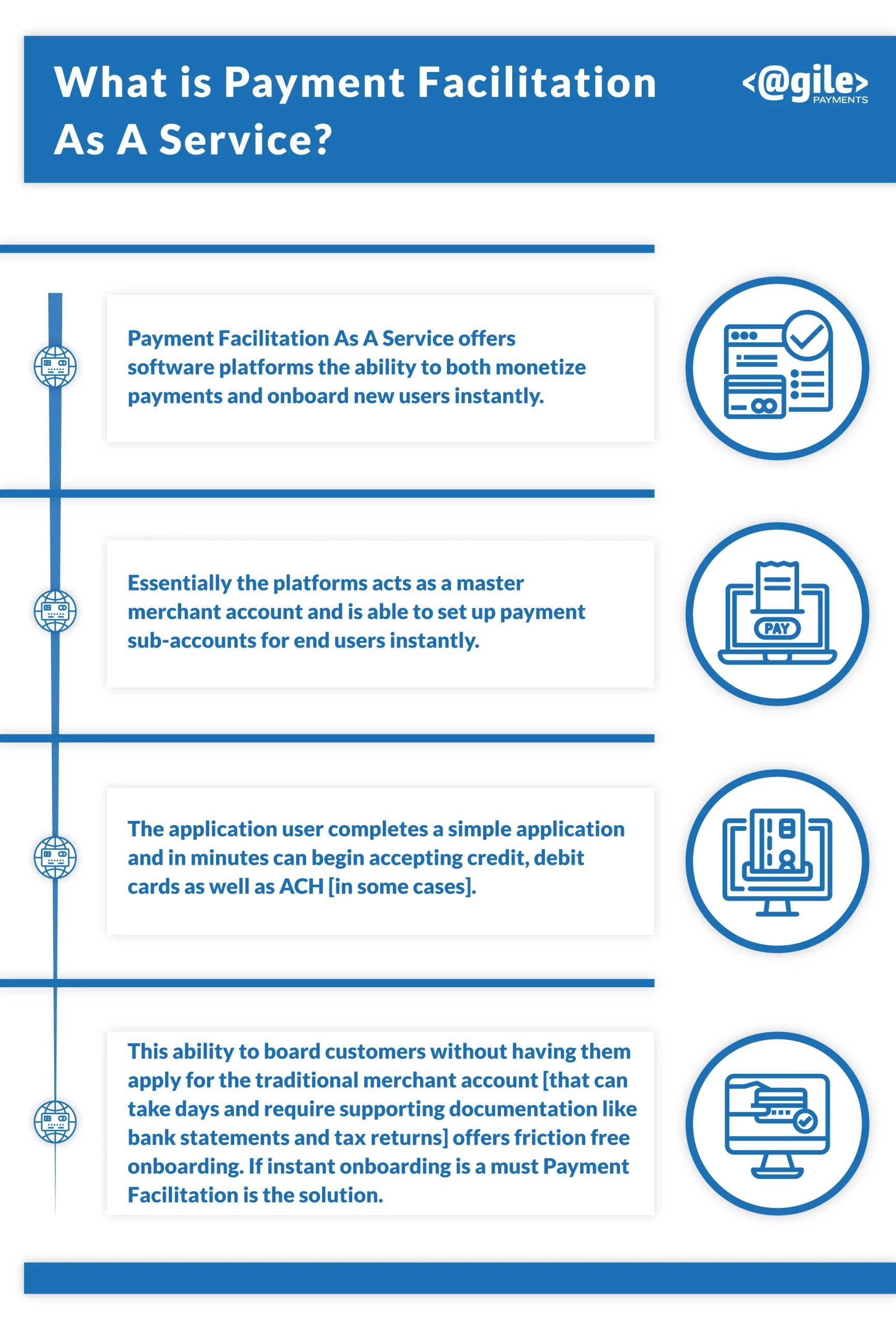

In the Payment Facilitation As A Service model you are in essence a sub-PayFac. So a true PayFac assumes all those compliance and regulatory and infrastructure costs.

They have created a platform for you to leverage these tools and act as a sub Payment Facilitator. They have a lot of insight into your clients and their processing. This level of insight mitigates much of the financial risk alluded to above.

This Managed PayFac or Hybrid Payfac offering is what we call PayFac as a Service. Like many cloud applications, you are essentially licensing a powerful solution at a fraction of the cost it would take to build.

For the vast majority of platforms, it simply makes little sense to become a true Payment Facilitator.

The question then becomes: “Why go down the true PayFac pathway?”

The Payment Facilitation As A Service model does have a downside. In the true PayFac model if “My Medical” was a client of Health Care platform offering payment solutions then a patient sees “My Medical” on their credit card statement.

In the PayFac As A Service model, if your Master PayFac is “YourPay” for example, the patient would see “YPY* My Medical” on their statement [descriptor] where YPY* indicates YourPay as the master or true PayFac. This may not be an issue or it may depending on your business model.

Another reason to act as the true PayFac is you own the payment process and that customer. There is no one in between or involved. Certain businesses may value that, especially if you are positioning your application to be acquired.

Even then the Payment Facilitation As A Service model may still offer better solution.

There are multiple options for both full blown Payment Facilitation providers as well as PayFac as a Service providers.

What to look for in a partner?

First and foremost: Do they understand what your goals are for both your application and end-users?

Some providers are willing to provide the technology but very little insight or support. You are essentially left to figure things out. Adding more complexity to your never-ending list often means you delay getting to market. You want an actual partner. Someone who is vested in your success, can offer insights that save you time and money and offer insight into your distribution channel. Possible connections are also a big plus.

Have a conversation. Most of the time you will have a connection with the right provider for you.

For many, the most important question becomes: How does the Platform make money from Payment Facilitation As A Service ?

Revenue is derived simply from the difference in buy rate from the processing networks and the sell rate charged to the end customer. For illustration, if a Payment Facilitator knows their true overall cost amounts to 2.4% of processed volume and they sell at 2.9% their margin is .5% of dollars processed. If they process $10,000,000 per day that works out to $50,000 in revenue per day.

In the PayFac As A Service model there are two possible revenue options.

The first is revenue share. So the master Payment Facilitation provider may offer a 40 or 50% or more share of revenue as described above. The % depends on many variables including customer base, volume of transactions and dollars, support requirements etc.

You must keep in mind that allowing your platform to leverage Payment Facilitation has hard costs and ongoing costs. Becoming a true Payment Facilitator takes $100k+ initial investment plus ongoing payments costs. True Payment Facilitation ultimately means you are becoming a payments company.

Some platforms may be able to secure a cost plus revenue plan. An example would be cost plus .30%.

In this model if true cost is 2.05% then the platform has cost = 2.35%. If they sell at 2.9% the margin is .55%. There is profit in per transaction fees as well.

There is also a third alternative to becoming a sub Payment Facilitator while still being able to offer fast account set up. You may find a Third Party Processor with slick API’s for merchant account onboarding that offers a hybrid blend between traditional re-selling merchant accounts for a TPP and acting as a Payment Facilitator. Advantages are no risk, no support and much lower implementation costs. You still gain revenue benefits without admin burdens. It is unlikely you would be able to provision accounts as quickly as if acting as the PayFac, but this may be the best fit for you. Especially if you want to focus on your core product but realize payments can play an important role is business growth [and revenue generation].

In summary, the PayFac As A Service isn’t for everyone but that’s not what is important. The question is “Is it right for you”? That’s a question best answered by having a conversation with you guessed it: Agile Payments. Our strength is creating partnerships that help your business be more profitable.

We’ll get back with you just as fast as we can.