What does the new NACHA ruling around WEB ACH transactions really mean and why has it been implemented?

Beginning March 2021, NACHA will implement a new rule that mandates enhanced checking account verification measures.

Businesses that debit payments via ACH for online or web based orders are required to implement enhanced fraud detection to comply with the new NACHA web debit account validation mandate.

Specifically, the organization will require such businesses to include, at a minimum, Checking Account Validation as part of a “commercially reasonable fraudulent transaction detection system.”

The change enhances NACHA’s anti-fraud mitigation. Simply stated, the new NACHA checking account validation rule means checking to make sure that the checking account routing and account numbers submitted for a given ACH transaction are valid. By valid we mean the account is open.

AgilePayments offers cost effective, easy to implement NACHA compliant solution.

Traditionally businesses rely on the consumer to input account information. For many reasons including bad data entry these transactions would get rejected when the customer’s bank received the debit instructions.

NACHA is looking to reduce these returns as well as trying to combat fraud attempts. A fraud scheme could work as follows: Person or entity looking to perpetrate fraud initiates low $ debit or pre-note transactions to identify open bank accounts. Note: A prenote is a zero $ electronic ACH inquiry. Prenotes were a popular tool to validate a bank account especially before recurring payment plans are scheduled.

The fraudster then pings accounts until they hit upon accounts they know are open. They would then initiate ACH debits to that account in hope of receiving monies. Once they received $ they would close their bank account to prevent a reverse debit.

There have been many such instances and in some cases big money losses have been incurred.

What does the NACHA WEB Checking Account Verification mandate mean for your business?

https://youtu.be/xR_qqwp00zoThe new NACHA rule specifically states that the businesses must employ a Checking Account Verification System as part of a “commercially reasonable fraudulent transaction detection system.”

More precisely, businesses that ask their customers to manually enter their account and routing numbers but don’t perform account validation will not be compliant. (the upcoming rule change doesn’t affect credit or debit card payments).

This means any business accepting a payment or changing a payment method must employ some validation tool or system.

If your website includes ACH as a method of paying for goods or services you must implement one of the solutions we outline below. If you rely on a shopping card solution, your cart provider must implement or integrate a verification solution.

The implementation deadline was originally set for January 2020, but NACHA pushed it back to March 2021 in order to give online merchants, financial institutions, and other businesses more time to get ready. All together, NACHA represents more than 10,000 financial institutions, so the impact will be broad and far-reaching. The new NACHA account validation rule takes effect March 19,2021.

What are your options to validate Checking Accounts in the NACHA WEB mandate? And which is your best fit?

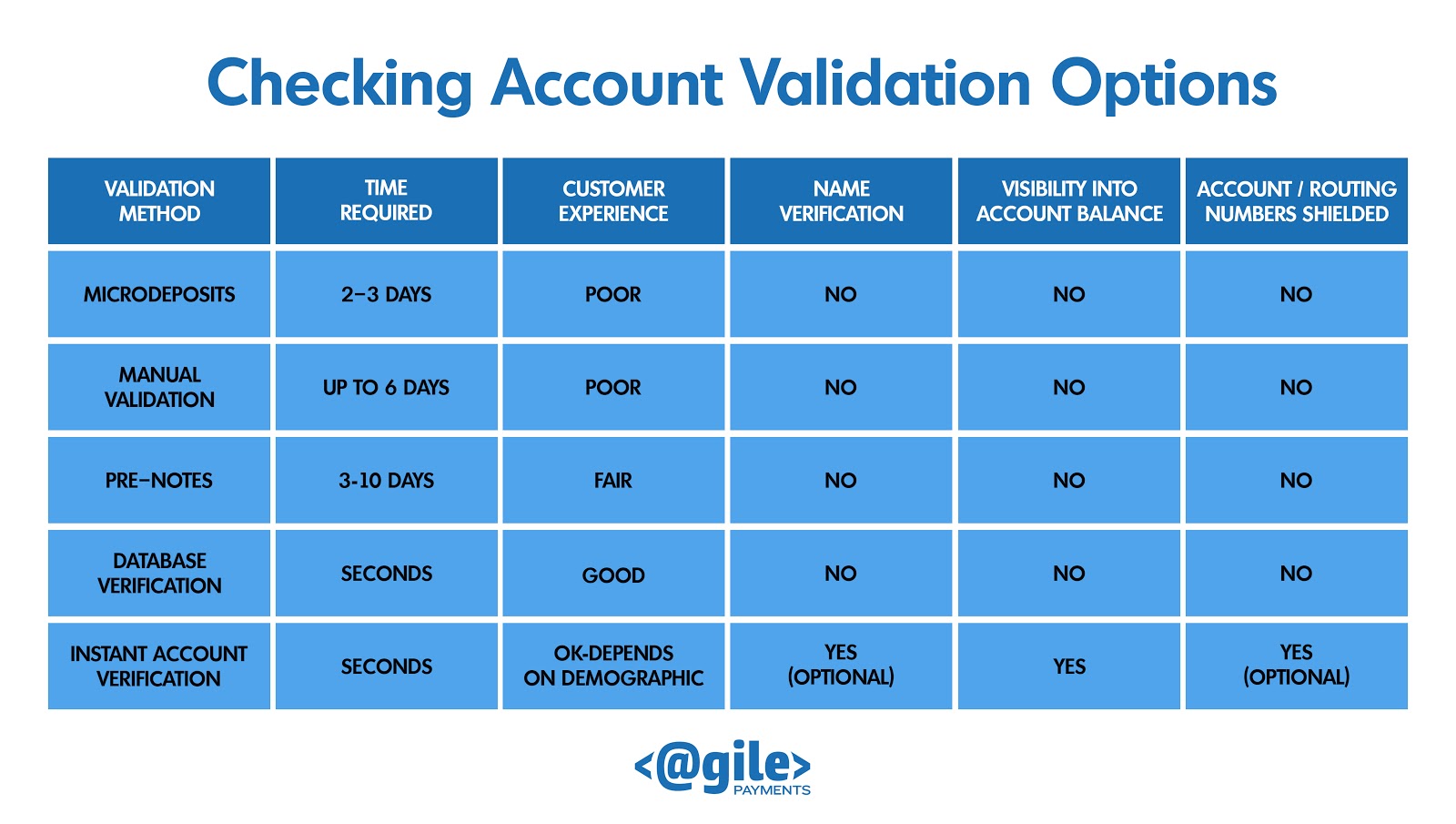

You potentially have five options. For businesses that rely on automation the first two are likely not great fits.

1-Manual check: The customer must be involved on call with their bank or produce bank statements. Certainly not an ideal customer experience. So a 3-way call between the merchant, customer and the customer’s bank is required.

2-Microdeposits: These typically involve two steps. Businesses make one or two small deposits (usually just a few pennies) into a customer’s account. The customer then confirms the amounts deposited. It often takes 2-3 days, and consumers often fail to complete the process. Before the advent of options 3 and 4 this was the most popular tool used.

3-Prenotes: Prenotes these similar to microdeposits—however these do not require confirmation from the customer. The originator sends a $0 transaction through the ACH network to verify that the account is valid. Pre-notes typically take 2-3 days. Pre-notes are seldom used as some 3rd party processors don’t support them.

4-Bank network database: Most of the banks and Credit Unions in the U.S. contribute checking account data on a daily basis. This data lets a business know an account is open and in good standing (or not).

The pros are very fast response times, economical and non-intrusive. The consumer enters account data and a call is made for a response. Con is you do not get a balance check or confirmation requisite funds are in the account. Additionally you are not validating Checking Account Ownership

5–Instant account verification: This method utilizes application program interfaces (APIs) and secure digital connections to banks, with account and routing numbers retrieved directly from the accounts being authenticated.

Customers simply select their bank from a list, enter their bank login and password, and their accounts are digitally connected in 7-11 seconds. In addition to linking accounts, some APIs can also be used to retrieve balance, identity, and transactions information. Pros: validate account plus ownership and balance is possible. Cons: Fairly intrusive process and customers may refuse to provide account log-in info.

For businesses that need to have a “future look” at the customer checking account this option can prevent creating an NSF or overdrawn account. When dealing with the syb-prime market this can be important on multiple levels.

Which is the best option for your business?

We believe options 1,2 and 3 are typically not the best fit.

Your customer base and potential for fraud will dictate better options between 3 and 4. If you are onboarding or taking payments from a new customer that you know nothing about, e.g., enrolling in a Venmo like app, then instant bank verification costs are worth paying because you are mitigating risk and smoothing enrollment. If your demographic is younger they are more likely to tolerate having to log-in to their online platform.

If on the other hand you are dealing with known customers or your business is low risk and recurring in nature the bank network database inquiry offers risk mitigation and compliance at much lower costs.

In terms of fees the bank network inquiries will typically cost in the 30 cents range per inquiry.For instant bank verification expect to pay $1 or more per transaction with monthly minimums from $250-$500+.

March 2021 is not that far away. Look to implement your solution as soon as possible to avoid non-compliance issues. Contact AgilePayments for more info.