Many businesses need to mitigate risks when onboarding a new customer. These needs can vary but typically there is the need to:

Typically the consumer visits a business website and when they purchase or sign-up the consumer is prompted to log-in to their online bank account via a lightbox or pop-up screen.

Once the consumer has logged in the business can tag along and pull account data via an API. In some cases, there can be repeat peaks into the consumer account. This feature is typically used to validate bank balance.

Instant Bank Account Verification is especially attractive to lenders and businesses that want to enroll a customer into a recurring ACH based payment plan.

For many businesses no authorization component means that an Instant Bank Account Verification System is needed to mitigate payment acceptance risk.

New client onboarding is a major friction point for any business that relies on future recurring payments. Examples would be insurance companies with premium payments, an alarm monitoring business collecting monthly monitoring fees or car loan repayment.

The customer may provide their bank account and routing info or a voided check might be taken. In either case, there is the potential for user error when inputting data. Using an Instant Bank Account Verification tool this risk is significantly reduced.

What risks does Instant Bank Account Verification mitigate?

Instant Bank Account Verification can help mitigate the following payment-related risks:

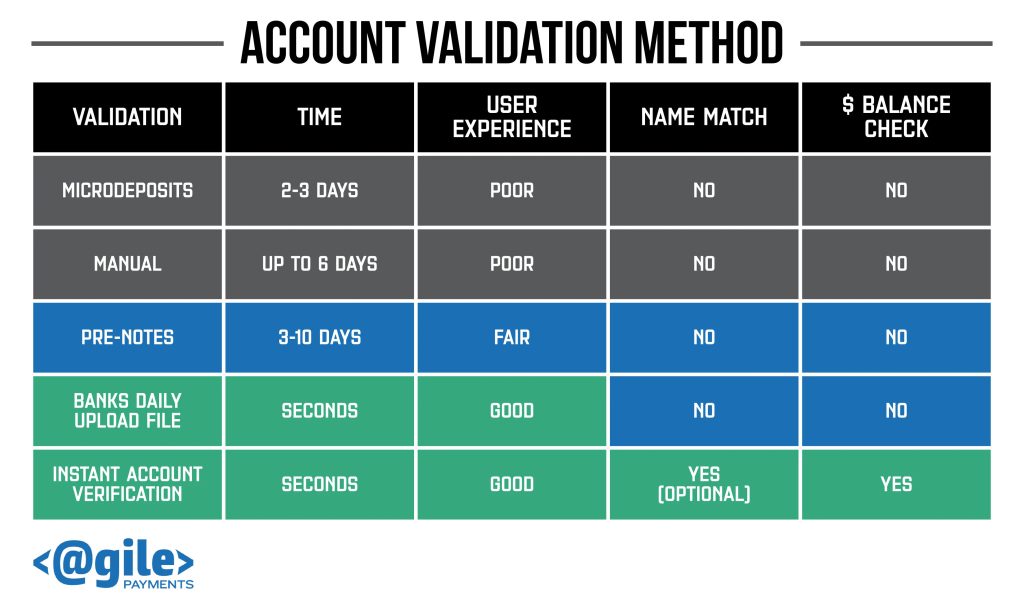

Instant Bank Account Verification versus existing Checking Account Verification Tools

In the past, it was common to initiate a pre-note to the consumer bank account. A pre-not is a zero $ inquiry sent to the consumer’s bank account. In 2-3 days if a bad account notice was not returned you could assume the account was good. Issues are time delay and that you are only validating account data. Ownership, balance, and history are not available.

Microdeposits became the de facto solution. A business would deposit small-dollar amounts and ask the consumer to then validate those $ amounts. As you can imagine there is friction and user adoption drops off. Again you are only validating the account is valid.

Another option is negative databases. Based on history [both positive/negative] of that checking account info, a response is returned regarding the account status. An example would be writing a check at Home Depot. If the check is good or bad, Home Depot can report that check status to the database. With many retailers contributing data to the network, there are many millions of checking accounts to reference.

Recency is an issue, as the customer’s last instance of writing a check at a participating retailer becomes the last data point. This means that data can be stale or a known bad check writer may not have made it into the database in a timely fashion.

The next level is Real-time Check verification and comes from banks and Credit Unions contributing data from their ATM network. A daily upload of account status is made to the network and queries to the network can provide account insight. When a check verification inquiry comes in a real-time response can be generated. These responses can tell you:

Although this solution reduces risk, can be automated and offers nearly instant responses, it does not balance check nor authenticate account ownership.

For lower-risk businesses, this solution may be the better option as the per cost inquiry difference is substantial.

To learn more about Instant Check Verification contact AgilePayments today

Instant Bank Account Verification validates at checkout or onboarding that a bank account is open and in a positive standing. Instant Bank Account Verification that are leveraged via bank log-in can also validate name and available balance

Using bank log-in as referenced above is one option. A second option naked an API call to a database populated daily with information from the vast majority of banks in the US. This service only checks that the routing and account #’s correspond to a “good” account

When onboarding a new customer who will paying (typically monthly) both the API-driven and bank login Instant Bank Account Verification solution can help smooth enrollment issues arising form either a mistyped account or routing #.